“Deliver more with less” – this is becoming the guiding principle for portfolio leaders struggling to bridge the increasing demand with never-ending resource constraints. What is more, it’s no longer sufficient to deliver projects on time and within budget; in addition to that, projects should deliver measurable business value.

How can business executives and portfolio leaders navigate this demanding reality? The solution is value-based portfolio management.

Read the article to discover more about this approach and how it empowers enterprises to ensure consistent value delivery under conditions of present-day changes and challenges.

What is Value-Based Portfolio Management?

Value-based portfolio management is an approach to managing an organization’s portfolio of projects and programs that focuses on creating and maximizing business value. In contrast to traditional portfolio management methods that prioritize completing projects on time and within budget, value-driven portfolio management focuses on doing the right projects, i.e., those that generate the greatest value with current resource constraints.

The meaning of value isn’t the same in different organizations. It may involve financial value (e.g., reducing costs), customer value (solving customers’ problems), operational value (improving processes), environmental value (reducing carbon footprint), etc.

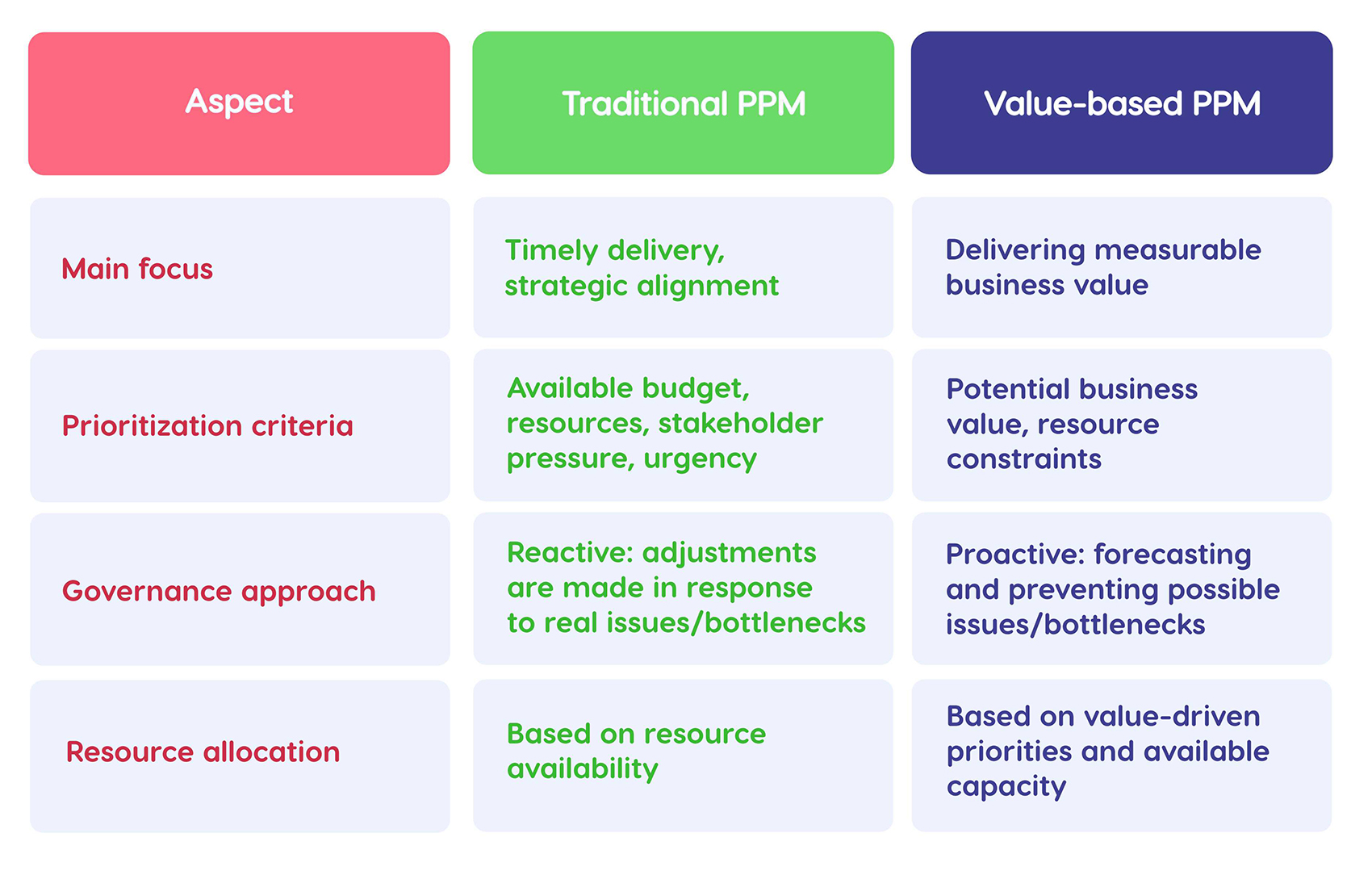

Traditional vs value-based portfolio management

Let’s now compare value-based portfolio management with the traditional approach.

Therefore, value-based portfolio management is about executing a collection of projects that will generate most value for a business organization and focusing limited resources on these initiatives.

Let’s now consider the detailed description of the main principles of value-driven portfolio management.

The Core Principles of Value-Based Portfolio Management

1. Viewing projects as strategic investments.

Value-driven approach implies that every project isn’t just an endeavor with a defined timeline and budget, but it’s a strategic investment. It means that every management decision regarding this project will be made based on its potential to deliver measurable returns (that can be financial, operational, social, etc.). It’s no longer the project’s feasibility or budget availability that matters, but their potential to contribute to a company’s strategy and generate business value.

2. Aligning portfolios with business objectives.

Value-based portfolio management requires connecting every project with business objectives. This helps organizations ensure that investments (time, money, human resources) are focused on achieving desired outcomes, e.g., revenue growth, market expansion, innovation, sustainability, etc.

3. Proactive portfolio management.

Proactive management involves forecasting and addressing potential issues and risks before they spread and escalate. For example, it involves forecasting risks to mitigate them or taking advantage of new opportunities. Also, this is about predicting bottlenecks and preventing them before they spread and cause serious issues across the portfolio. In contrast to reactive management, which deals with problems that have already occurred, proactive portfolio management prioritizes preventing problems in advance.

4. Prioritization based on business value.

In a great number of organizations, the decision on starting a project is made based on the availability of funds or stakeholder pressure. But let’s be honest, are these criteria correct if the executives are expecting to generate measurable business value? Of course, not. Value-based portfolio management implies that project selection and prioritization should also be value-driven. It means that projects in the portfolio should be analyzed and scored to select a combination of initiatives that will generate maximum value for an organization.

5. Taking resource constraints into account.

Resource availability is the biggest constraint for the majority of organizations running multiple projects, which is however frequently overlooked. As a result, companies have overloaded teams and delayed projects and face the need to assign more and more resources to get things done. In contrast, value-based portfolio management considers resource availability and capacity as critical factors impacting project selection, alongside business value. This allows enterprises to deliver the most important projects successfully without overloading people and avoiding delays.

6. Making data-driven decisions.

When managing project portfolios, every decision should be weighted; there shouldn’t be any guesswork or office politics. Value-based portfolio management implies performing scenario analysis, assessing and discussing potential outcomes, and basing every decision on data-driven insights. This reduces the risk of bad management decisions that can negatively affect other projects in the portfolio.

Now that we understand the main principles, let’s consider the benefits that enterprises can achieve upon adopting value-based approach.

Benefits of Value-Based Portfolio Management

Aligning projects with business objectives

Value-based portfolio management ensures that a company executes only projects that generate high strategic value. This reduces waste of resources, time, and money on projects with lower business impact.

Value-driven prioritization

Value-based portfolio management lets organizations focus on projects that will drive the highest business impact for an organization. It implies prioritizing projects based on their business value. This eliminates guesswork and politics-driven prioritization, which in turn reduces resource waste and lets enterprises direct resources to what is really important.

Improving resource utilization

Value-based portfolio management involves intelligent utilization of the available resources across projects. This is achieved thanks to the following actions:

- Resource capacity planning;

- Workload balancing;

- Eliminating bottlenecks;

- Allocating resources to projects with the highest value.

This will allow you to increase resource efficiency, reduce idle time, prevent overloads and, what is most important, direct limited resources to projects that should be delivered first.

Making confident decisions

The value-based approach offers clear criteria that should be taken into account when making decisions. The value-driven approach to portfolio management requires making data-driven decisions.

Addressing portfolio management challenges

Business organizations running programs and project portfolios usually face similar challenges:

- Too many projects in execution at the same time.

- A lack of skilled resources;

- Overloaded teams;

- Project delays.

Value-driven portfolio management approach provides organizations with the required insights and strategies to address these issues and improve portfolio performance.

Maximizing portfolio performance without extra resources

The truth is that you don’t have to add extra resources to get the work done. Value-based approach to portfolio management allows you to deliver more without extra resources thanks to setting correct priorities, allocating limited resources to the highest-impact projects, and eliminating bottlenecks.

How to Implement Value-Based Portfolio Management in Your Organization

Below are the five steps that will help you implement the value-driven portfolio management approach or optimize existing portfolios if they are underperforming.

Step 1. Begin by defining the strategy.

The first step towards applying the value-based approach or optimizing the existing portfolio is determining the right strategy. The company’s leadership should clarify: Why are we executing all these projects? What value will they bring to our organization? This will set the right direction and ensure that every project will support organizational strategy and won’t be wasting resources and budget.

Step 2. Identify high-impact projects.

Doing everything at once is a costly mistake that leads to overloads, delays, wasting money, and low value. So, you need to determine which projects are really important for your organization at the moment. Value-based approach helps you prioritize projects that generate the greatest measurable impact, whether financial, operational, customer-oriented, social, etc.

It’s critically important that prioritization is driven by expected business value, not project feasibility or funding availability.

Step 3. Analyze resource availability and constraints.

Even the most promising projects will fail if there are no available resources for their completion. So, you should align your priorities with available resource capacity. Evaluate your current situation to understand the realistic potential of existing resources. Aligning resource capacity with value-driven priorities will ensure successful delivery of the most valuable projects and prevent overload and delays.

Step 4. Allocate resources to the most valuable projects.

After you’ve determined project priorities and available capacity, you can assign resources to the projects with the highest business impact. It’s important to balance workloads and not overload your people: balanced workloads will increase productivity and prevent bottlenecks and delays.

Step 5. Use scenario analysis to guide decisions.

Intelligent portfolio decisions cannot be driven by assumptions or internal politics. Use scenario modeling to simulate resource and investment distribution and their impact. It will help you compare different outcomes and select the scenario that will deliver maximum value to you organization.

Read more: Optimizing Portfolio Profit Through DIPP-Guided Resource Allocation

Applying value-based portfolio management should be supported by intelligent portfolio management software. Let’s consider its assistance in the section below.

Value-Based Portfolio Management Software: Epicflow Portfolio Optimizer

There’s a variety of portfolio management tools available on the market. But is there PPM software designed for portfolio optimization?

Epicflow is ready to introduce its innovative solution – the world’s first portfolio optimization engine (EPO) that helps business organizations develop the right strategy for maximizing the value of projects they’re working on.

But let us briefly introduce Epicflow first. It’s a portfolio resource management solution that supports organizations running multiple projects at all levels – strategic, tactical, and operational. It helps them set the right priorities, optimize utilization of shared resources, and ensure that they can deliver more projects without increasing the headcount.

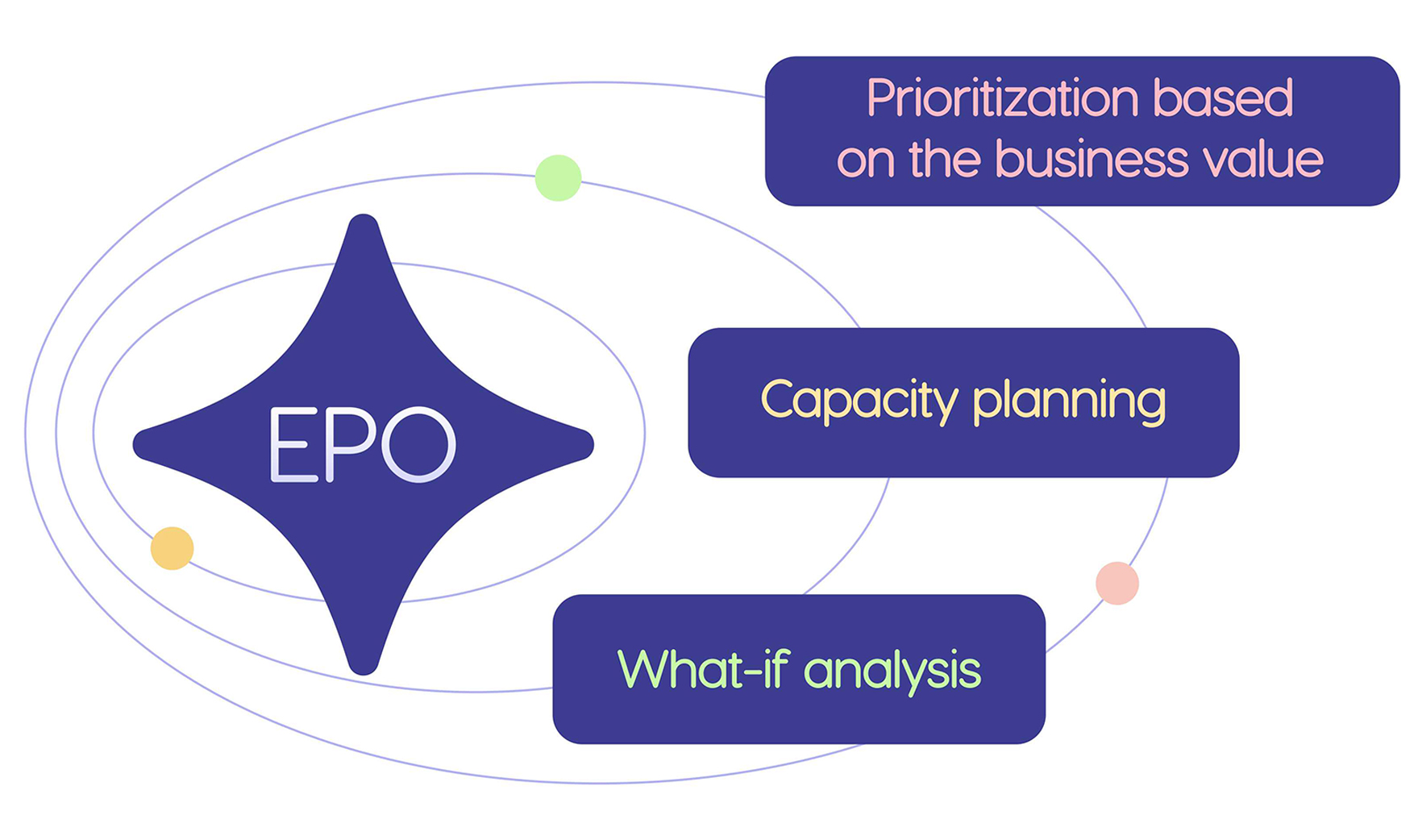

Now, Epicflow goes further by offering functionality for optimizing portfolio performance based on resource constraints and business value. This functionality is perfectly aligned with the principles of value-based portfolio management and addresses the main challenges of enterprises running multiple projects. Let’s take a look at the key features of the EPO:

- Prioritization based on the business value: Shows you what projects require resources most.

- Capacity planning: Provides insight into people’s capacity and workload, so portfolio leaders can make sure that no team is overloaded and won’t become a bottleneck.

- What-if analysis: Let’s you play different optimization scenarios before selecting the best combination and sequence of projects that will boost value for your organization.

EPO supports enterprises at the highest strategic level, and that’s for a good reason: based on our experts’ experience from working with clients, the right portfolio management strategy and prioritization are the key drivers of high performance, value creation, and achieving business goals. With Epicflow Portfolio Optimizer, organizations can allocate their limited resources to really important projects and deliver more value without extra investments.

Contact us for more information about EPO and its transformative impact on your portfolio management strategy.

Read more: The World’s First Value-Optimised Portfolio Engine

Real-Life Examples of Value-Based Portfolio Management Approach

Let’s now consider the real-world cases of portfolio optimization using the value-based approach.

Case 1. From delays to huge performance gains.

A large IT department of the Dutch MOD was drowning in hundreds of delayed projects. They had too much work in progress, their teams were overloaded, and most projects were significantly delayed.

With Epicflow, the situation changed dramatically: they achieved 30% reduction in lead times and gained 300% improvement in on-time delivery without increasing the headcount or additional investment.

These results became possible thanks to adjusting the strategy and focusing on projects with the highest business value. Also, Epicflow helped the department reallocate resources and eliminate bottlenecks, which balanced teams’ workloads and focused them on really important projects. This example proves that improving portfolio performance doesn’t require bigger budgets, only a smarter strategy and prioritization.

Read more: Why Smarter Delivery Beats Bigger Spend: Experiment at the Dutch Ministry of Defense

Case 2. Increasing portfolio performance with limited capacity.

Formula 1 teams were running dozens of R&D projects while facing capacity constraints and time pressure. Delivering these initiatives on time was a real challenge, but not for Epicflow. With its optimization opportunities, F1 teams managed to select the highest-priority projects based on their specific criteria, run simulations to choose the combination of projects with the highest value potential, and free up resources’ capacity to complete them on time.

As a result, Epicflow helped the F1 team maximize performance despite limited capacity without overloading the team members.

Final Thoughts

As we see in the current business environment, enterprise portfolio management success is no longer determined by the number of projects an organization can complete. The question is: How much value can these projects deliver?

Value-based portfolio optimization empowers businesses to focus on projects with the highest potential for strategic return. This shifts focus from project execution to delivering value, and requires intelligent strategy and prioritization.

With the right mindset, data-driven insights, and intelligent tools like Epicflow Portfolio Optimizer (EPO), enterprises can transform their portfolio into value-driven engines, ensuring sustainable growth and competitive advantage.

Frequently Asked Questions

What is value-based portfolio management?

How does value-based portfolio management differ from traditional portfolio management?

What are the main benefits of value-based portfolio management?

- Aligning projects with business objectives.

- Intelligent project prioritization.

- Improved resource utilization.

- Optimization of decision making.

- Addressing portfolio management challenges.

- Maximizing portfolio performance and business value.