Project portfolio management isn’t just focused on the day-to-day management of resources and project due dates. It also includes multiple analytical and prioritization aspects. Project portfolio optimization is one of those processes.

Taken from financial investment analytics, PPO aims to find a portfolio variant that produces the highest value per constrained hour. In this article, we’ll explain how to achieve an optimal portfolio, what tools and methodologies you need to use, and look at a couple of examples of effective PPO.

Key takeaways:

- PPO is the analytical part of PPM that aims at optimizing the value density of a portfolio.

- Its main tasks are calculating ideal portfolio composition, resource allocation, and schedule.

- It relies on data analytical skills and using advanced methodologies for calculating those.

- AI-driven analytics tools can reduce the complexity of the process and analytical skill requirements.

What Is Project Portfolio Optimization?

Project portfolio optimization (PPO) is a specific subset of activities within portfolio management aimed at finding the optimal set of projects to maximize the business value the company receives from the limited resources it has. Simply put, portfolio optimization in PPM seeks to utilize company resources in the most efficient way possible.

To that end, portfolio optimization uses data analytics to make decisions on what projects to take on, how to sequence them, and what resources to allocate.

Types of Portfolio Optimization

There are a few typologies of portfolio optimization. Here’s one that breaks down the process in more general terms.

- Strategic optimization. Aimed at calculating how each project in a portfolio is aligned with the larger business strategy and finding the optimal mix of projects based on that.

- Risk optimization. Aimed at assessing financial, operational, and external risks across the portfolio and combining projects in a way that achieves the risk level acceptable for the organization.

- Financial optimization. Uses advanced analytical techniques with the aim to optimize portfolio ROI.

- Resource allocation optimization. Aimed at optimally distributing the workload in a way that allows to prioritize the most important projects and deliver them on time and within budget.

Using one of the types can be relevant in cases where a portfolio is unbalanced in just one aspect. In most cases, though, PMOs will have to use every type of optimization to achieve a perfectly balanced portfolio.

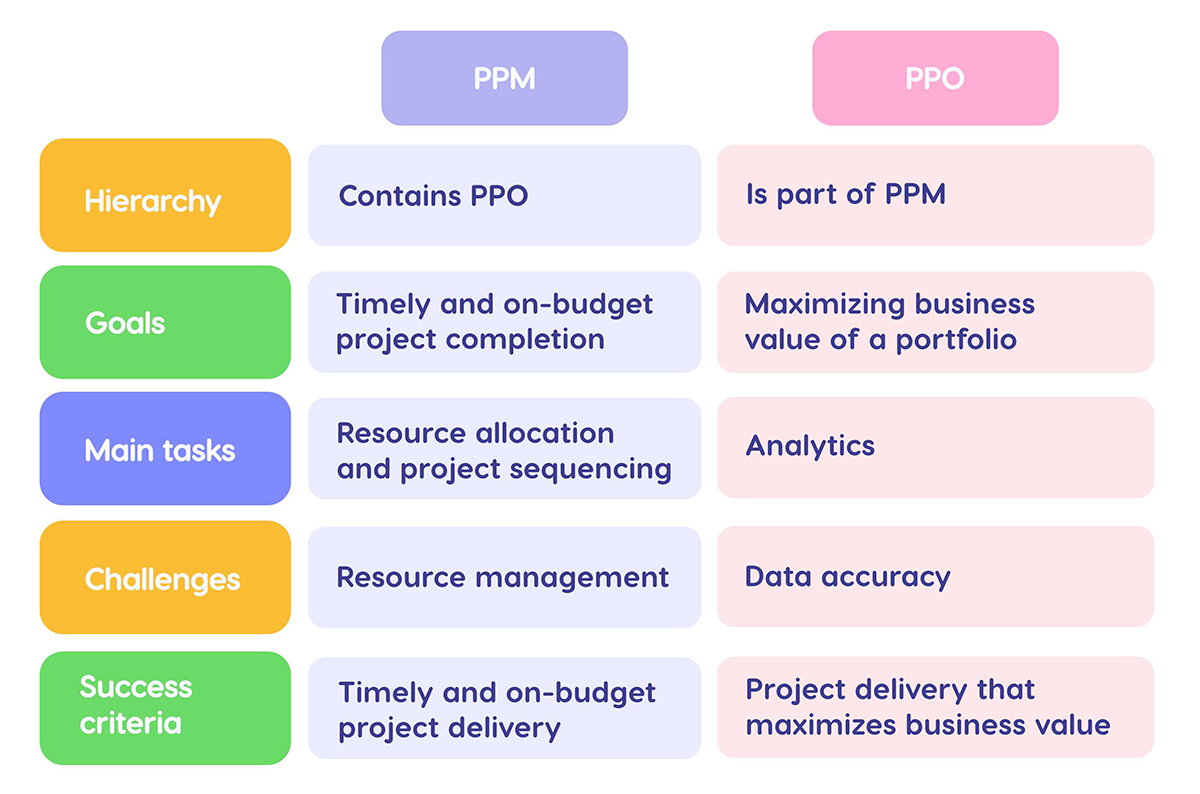

Project Portfolio Optimization vs Project Portfolio Management

Benefits of Optimizing Your Project Portfolio

Using a data-backed approach in portfolio management can help you achieve multiple benefits. Here are the most important ones.

Strategic Alignment

Understanding the strategic importance of each project in a given portfolio allows project managers to prioritize the portfolio and reach strategic company goals faster. This reduces wasted effort and contributes to company growth.

Better Decision-Making

Basing decisions on analytical tools reduces uncertainty and helps PMOs be sure in their management choices. It also paints a clear picture of the portfolio and the reasoning behind every decision for the C-level management.

Risk Mitigation

Including various risk factors in portfolio optimization analytics allows portfolio management specialists to arrive at a balance of risks that’s acceptable to the organization. The exact balance depends on its risk management strategy and overall goals.

Higher Value Density

A well-optimized portfolio delivers higher business value per constrained resource hour, improving productivity without having to increase headcount.

Improved ROI

All of these factors combined lead to an increase in ROI. Focusing on the right projects, sequencing them and allocating resources to them with value maximization in mind allows the portfolio as a whole to perform more productively.

PPO Methodologies and Tools

Quality data analytics is one of the success factors of portfolio optimization. Here are the methodologies and tools you’ll need to use.

Operating/competitive necessity

The easiest and the most subjective methodology for selecting projects in a portfolio is the operation necessity method. You simply exclude several projects that are needed for the company’s operations from other calculation methods and prioritize them based on the fact that the business won’t function without them.

Processes like regulatory compliance are hard to judge in formal qualitative calculations, so prioritizing them based on stakeholder opinion is the only option.

Beware of adding irrelevant processes to this category, though. Compliance is necessary for business survival, keeping a certain product or customer is not.

Scoring models

A very common way to optimize a portfolio is to score each project in it according to several criteria and leave the most important ones. Here is how it’s done.

- Develop several criteria for business impact. For example, cost-optimization or improved revenue.

- Develop several risk factors. For example, probability of delay or lack of project impact.

- Rate each project in the portfolio across all the criteria. You can use percentages or a Likert scale for the rating.

- Calculate the final score for each project.

The most common approach to prioritization of projects on this list is to sort them from the highest to the lowest score and keep them until you run out of budget. This does provide a clearer understanding of the portfolio’s value, but simply keeping the projects as long as they fit the budget doesn’t take resource availability and ROI into account.

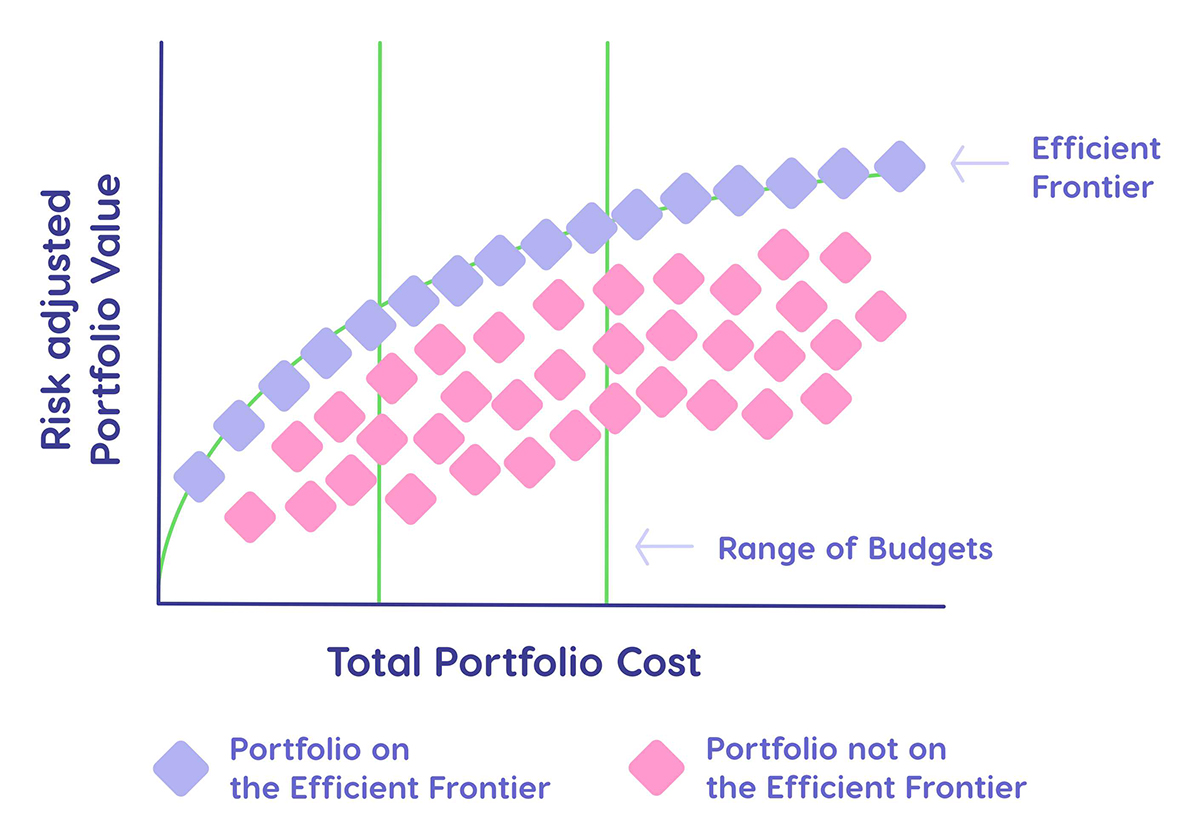

Efficient Frontier Analysis

A better way to optimize a portfolio is to run an efficient frontier or cost-value analysis. This analysis that comes from financial analytics is aimed at evaluating projects across two axes: investment and business value, either strategic or financial. Applying it to your portfolio can help balance it with efficiency in mind.

Efficient frontier analysis takes the risk-adjusted value calculations and project budget to create a graph that represents multiple portfolio scenarios across these two axes.

The efficiency frontier is the curved line on the top that shows portfolios with the most efficient mix of projects for a variety of budgets. The projects that are below that line are suboptimal, meaning you can either get the same value at a lower budget or get more value with the given budget.

This analysis comes from financial portfolio analytics where you can easily lower the investments and have many ways of increasing them. In financial investments, this graph is great for finding the point of diminishing returns and finalizing budget decisions.

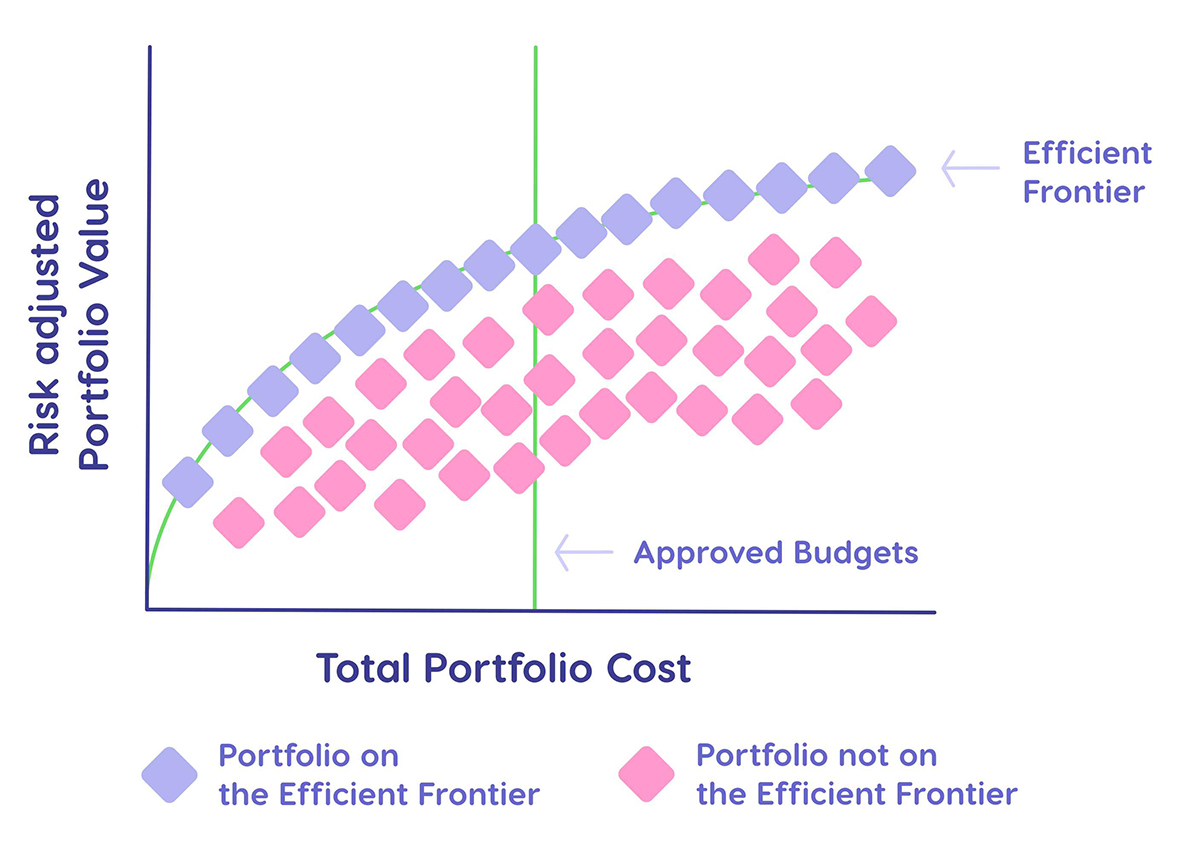

In project portfolio management, budget is one of the main constraints, so a few adjustments have to be made.

First, the calculation should be made for a narrower range of budgets because firing or hiring human resources isn’t something the portfolio optimization in PPM has much control over. You can include 10-15% difference from the approved budget to look at risks associated with reducing the workforce and potential benefits of hiring more staff.

Second, in financial analytics, you’d be looking primarily at the efficient frontier. In PPM, you’ll be looking at the narrow line of the agreed upon budget and the wide range of portfolio variants. If changing the budget is out of the picture at the moment of portfolio optimization, you may have to choose a suboptimal portfolio.

There are a few valid reasons to do so:

- Project dependencies. If the efficient frontier portfolio excludes projects with low ROI that high-ROI projects depend on.

- Operating necessity. If the efficient frontier excludes low-ROI projects needed to run the business.

- Inability to increase budget. If the portfolio option that is on the efficient frontier is out of the approved budget range.

Even with a few drawbacks, this analytical framework provides a detailed breakdown of most possible portfolio variants. It’s great both for basing decisions on and for showcasing different trade-offs to the stakeholders.

Resource Optimization

Resource optimization aims at modeling portfolio performance based on resource constraints and finding an optimal portfolio in terms of resources distribution. One of the drawbacks of cost-value analysis is that it cannot assess the differences in skills of allocated resource budget so its analysis of value can be a bit distorted.

Resource optimization tools can help you analyze the portfolio in more detail and optimize it realistically.

Schedule Optimization

Schedule optimization helps with sorting projects in time based on their interdependencies. It is a good choice of methodology both before and after cost-value analysis. Analyzing project interdependencies to understand what projects are a part of a multi-project critical path and should be included in the portfolio despite their lower ROI.

Using schedule optimization after a few portfolio variants have been chosen lets you arrive at an optimal portfolio timeline that ensures there are no bottlenecks and delays in project execution.

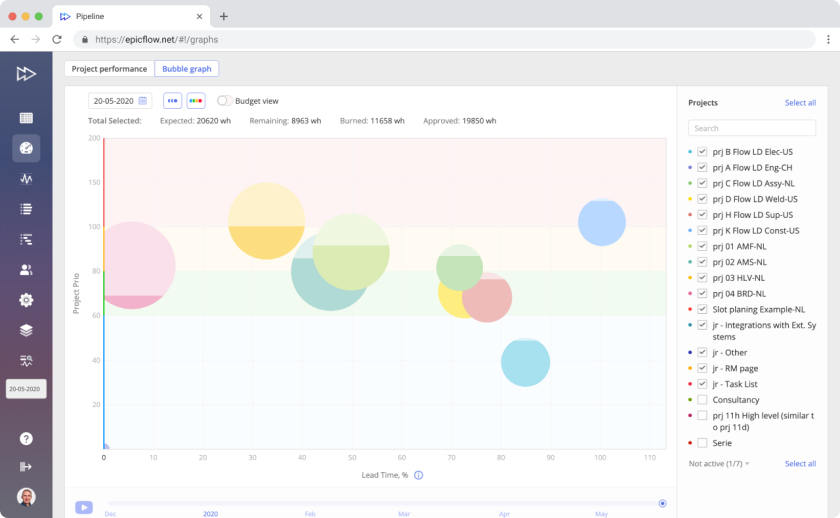

Data Visualization Tools

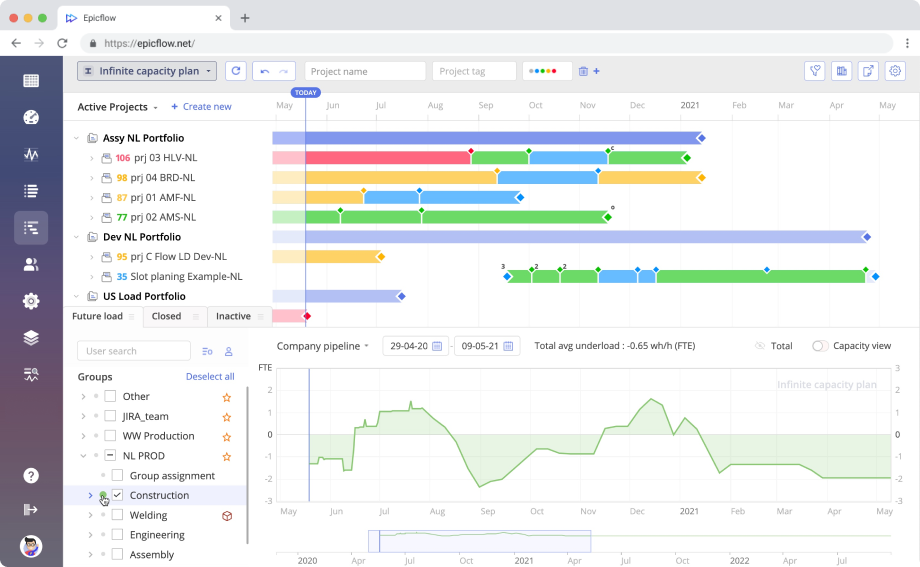

Project portfolio optimization charts can help a lot in portfolio inventorization and assessing projects’ performance. For example, Epicflow dashboard can visualize the portfolio in the form of a bubble graph. It visualizes project flow with due date in mind and highlights whether projects fit within budget with dashed lines over the bubbles.

AI-Driven Optimization Algorithms

Tools like Epicflow’s AI Portfolio Optimizer can help you optimize your portfolio without much knowledge in data analytics. It takes the input in the form of project details, value scoring, and resources available and arranges your portfolio based on the maxim of optimizing business value per constrained hour.

Book a call with our team if you want to learn more about how Epicflow tools can help you optimize your organization’s portfolio.

6 Key Steps Of Project Portfolio Optimization

PPO can be broken down into the preparation stage, the analytics stage, and the execution stage. Here are the steps of portfolio optimization you’ll need to go through.

Update the Strategic Priorities

A lot of decision-making and analytics in project portfolio optimization relies on the company’s strategic vision. Especially when it comes to choosing risk profiles or optimizing a portfolio of R&D projects where financial value is not straightforward.

Make a quick update of what they are to ensure your optimization efforts are aligned with the overall strategy.

Portfolio Inventorization

The next step is to take inventory of your portfolio and understand each project’s current state. You can do this with project progress software. Add to that any projects that are planned to begin and data from past projects. It can help you update the understanding of resource constraints and possible risk factors.

Analytics

With that, you can start analyzing the portfolio. If you’re using a scoring method, you’ll need to develop a set of criteria and rank each project for them.

Run the scores through analytical software and use PPM software on your portfolio for resource and schedule optimization. This should give you enough data to pick the optimal portfolio composition.

Project Selection

When that data is in your hands, you pick the projects that need to be executed and adjust the timeline to avoid delays and bottlenecks. This process typically involves presenting the decisions to the stakeholders and agreeing with them on how the portfolio should look like.

Resource Allocation

Once the portfolio is optimized and rescheduled, allocate resources to projects if any changes are necessary. Use data from resource capacity planning software to optimize this process.

Monitoring and Analytics

After all of that is done, analyze portfolio performance and adjust it or your approach to optimization accordingly. Look primarily at the business value provided by the portfolio. If the performance doesn’t line up with your expectation, you’ll need to rethink your scoring model as it either doesn’t reflect business value well or underestimates risks.

Common Challenges in Project Portfolio Optimization

A process as complex as PPO cannot come without several challenges. Here are the main ones.

Stakeholder Resistance

As portfolio management offices have to vet management decisions with stakeholders, resistance in C-level leadership can pose problems for the process as a whole. It can take a form of a stakeholder disagreeing with altering project due dates because they believe it’s important for their position in the company or a group of stakeholders having vastly different expectations of what can be achieved with the company resources.

Calculations alone may not be enough to change their minds. To do this, you can either use interpersonal skills to understand what is the reason a stakeholder objects to changes and work with that, or use an old marketing trick. Instead of showing the portfolio strategy you think is best, present three options, explain the trade-offs, and have them choose between those three.

Data Collection

Any analytical process relies on the accuracy of the data it’s based on. If your organization lacks portfolio data standardization, it can lead to an increase in manual work needed to be done to collect it, making portfolio optimization longer than it needs to be. Alternatively, it can lead to inaccurate data collection, which compromises the whole endeavor.

Data Analytics Skills

Even with all the data in place, it can be hard to arrive at an optimal portfolio because the optimization process requires a robust data analytics skillset. If your company’s portfolio management office lacks the skills needed, the results may not be as data-backed as you hope.

If that’s your case, there are four main options to handle this:

- Contract external help from an agency or a consultant.

- Hire a data analyst for the PMO team.

- Invest in training your team.

- Use AI-driven analytical PMO software like EPO that can extract insights from data for you.

Inability of Analytical Models to Account for All Variables

Analytical models rely on input data, and not every business priority can be organized into an input that makes sense in the context of other optimization criteria. Regulatory compliance work, for instance, wouldn’t rank very high in cost-value optimization, yet it is needed to run the business.

In cases like these, you can either add a custom weighted value to specific projects, or exclude them from traditional optimization calculations and use another decision making process.

PPO Case Study

Let’s look at a few cases of project portfolio optimization in practice.

Arnold AG

Arnold AG is a manufacturing company that specializes in high-quality metal products. Their main problem was inconsistency of planning approaches that led to the company having little idea what its real capacity is and how taking on additional projects would affect the portfolio.

With Epicflow’s help, they were able to create accurate estimates and understand their resource capacity. With that information, after looking through optimal portfolio options, Arnold AG was able to add more projects on short notice to maximize portfolio’s value without hiring additional resources.

TKF

TKF is a telecommunications company whose R&D department was suffering from resource overload and a lack of clear priorities. This led to resource overload and decreased output.

TKF turned to Epicflow for help, and after optimizing the portfolio based on driving business value, was able to focus on projects that mattered and deliver them on time. This, in turn, improved employee productivity, and with proper portfolio management, TKF managed to deliver more projects next year with the same amount of resources.

How Epicflow Can Help

Effective portfolio optimization is impossible without the right tools. Let’s look at a couple of features of Epicflow that can provide a PPM portfolio optimization infrastructure for your company.

Portfolio pipeline overview along with other ways to view your portfolio create a detailed and data-oriented bird-eye view of the portfolio your company currently has. It allows you to view the portfolio as a whole and get every little detail of each project that it contains.

You can view each individual project’s tasks, look at resource group compositions, and access data on portfolio progress and resource load. This is useful both in the initial phases of optimization to get a deeper understanding of the portfolio and in the final phases to make direct management decisions.

EPO, Epicflow Portfolio Optimizer, can organize your portfolio in line with your strategic vision and the resource constraints your organization has at the moment, taking the data analytics difficulties out of the portfolio optimization process. This AI-driven analytics tool can help you direct the limited resources your organization has to the right projects.

Book a call with our team to get more information on how you can integrate Epicflow into your portfolio optimization process and what results you may expect.

Conclusion

Portfolio optimization is a complex part of project portfolio management that requires data analytics skills and proper data management. If done well, it can improve company productivity and focus its resources on the projects that deliver the most business value with the resources you have at hand.

Scrutinize your portfolio data inputs, use data analytics tools to optimize it, and monitor your progress to alter the approach if needed.

Frequently Asked Questions

Why do organizations implement project portfolio optimization?

The major reason portfolio optimization is included in the PPM process is to optimize the business value a portfolio delivers within the resource constraints.

What is the difference between project portfolio management and project portfolio optimization?

The main difference between PPM and PPO is their goals. PPM as a whole is aimed at ensuring portfolio execution without delays. PPO is aimed at optimizing the business value delivery of a portfolio.

What are the key steps involved in project portfolio optimization?

The key steps of PPO include gathering data, data analytics, making management decisions based on the results, and continued monitoring of portfolio performance.

Which methodologies are commonly used for project portfolio optimization?

Most commonly, you’ll use a variant of the scoring method and cost-value analysis. Advanced AI-based project staggering and resource allocation algorithms are also used.

What challenges do companies face during project portfolio optimization?

Most often, organizations that want to do PPO will face stakeholder resistance, difficulty of gathering data, and a gap in data analytics skills in the PMO team.

What tools are common for portfolio optimization?

The most useful tool you can use for PPO is a portfolio organizer algorithm that sorts portfolios based on value per constrained hour. An example of such a tool is EPO, Epicflow Portfolio Optimizer.