When an organization doesn’t have a clear way to prioritize projects in a large portfolio, either prioritization happens arbitrarily or every project seems equally important. This often leads to a chaotic portfolio, resource overload, failure to deliver projects on time, and low ROI of the portfolio.

In this article, we’ll explore what project portfolio prioritization is, what methodologies you can use to prioritize projects, and explain what steps you need to take to prioritize your portfolio.

Key takeaways:

- Portfolio prioritization is a process of assigning value to projects in a portfolio.

- Its goal is to understand what are the most important projects for the company and sequence the portfolio in a way that focuses efforts on the right projects.

- Successful portfolio prioritization requires applying project prioritization methodologies consistently, managing stakeholder expectations, developing objective assessment criteria, and monitoring portfolio performance.

What Is Portfolio Prioritization?

Portfolio prioritization is the process of developing an internal system of value assignment to the projects and applying it to every project in the portfolio. To do this, PMOs use a wide range of methodologies that include voting and data analytics.

The end goal of portfolio prioritization is to understand which projects bring in the most value and focus the company efforts on them by adjusting timelines, reallocating resources or assigning more personnel, or discontinuing low-priority projects.

What Are the Portfolio Prioritization Benefits?

The benefits of implementing portfolio prioritization include:

- Improved decision-making. Clearly understanding the potential value of each project makes it much easier to take strategic decisions in portfolio composition or scheduling.

- Strategic alignment. Prioritizing the execution of the most promising projects, whatever metrics you use to determine that, ensures company efforts are spent on driving strategic goals.

- Resource optimization. Prioritization allows organizations to utilize available resources most effectively, without wasting them on low-value initiatives.

- Improved portfolio performance. When the right projects get prioritized, due date performance and throughput increase.

- Increased ROI. Thanks to prioritization of the most important projects,

What Are Prioritization Models and Methodologies?

There isn’t a single approach to portfolio prioritization. Instead, there are multiple portfolio prioritization techniques that you can choose from.

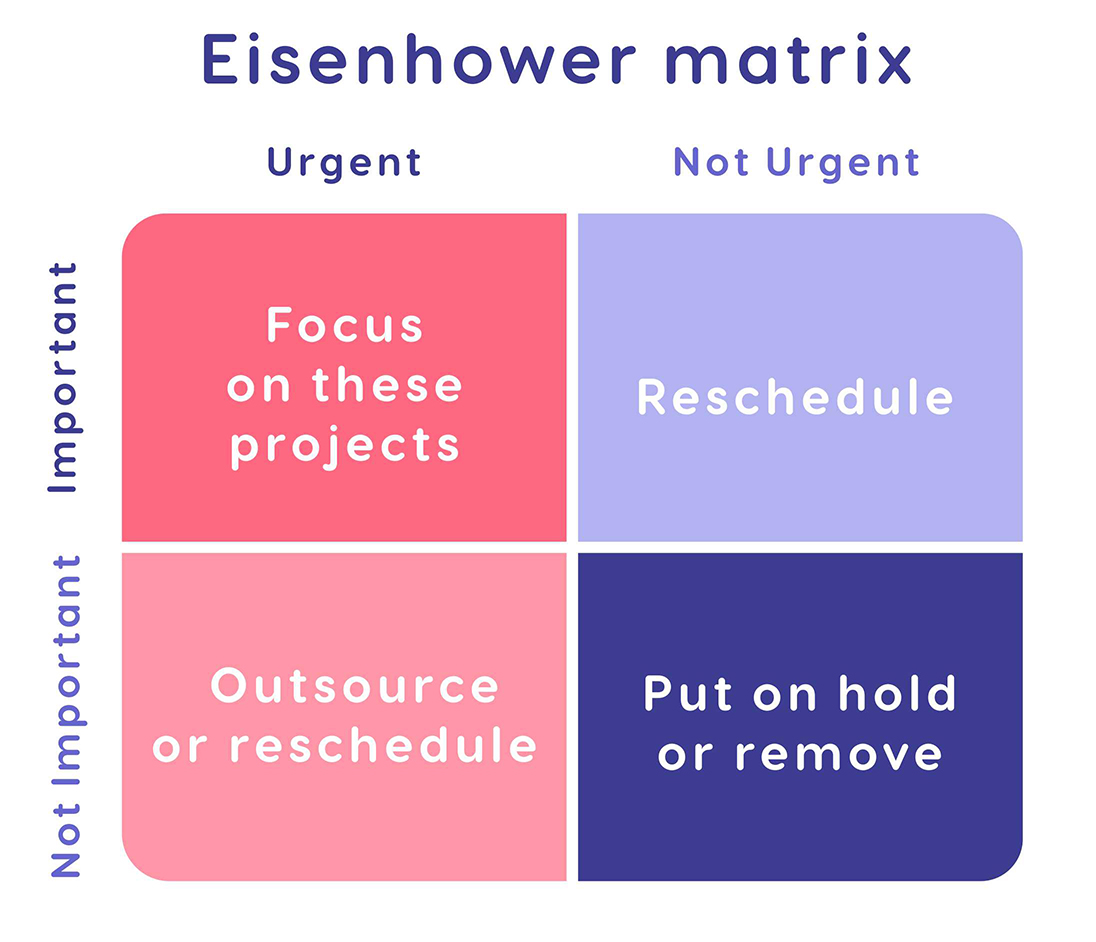

Eisenhower Matrix

One of the most widespread methodologies is the urgency-importance matrix, also known as the Eisenhower matrix. In this portfolio prioritization matrix, you put projects into four categories:

- Urgent and important. These projects should be focused on first.

- Not urgent but important. These projects can be rescheduled.

- Urgent but not important. These projects can be outsourced or given lower priority.

- Neither urgent nor important. These projects can be put on hold or removed from the portfolio.

The obvious drawback of this method is that it’s far too subjective. At the base level, the only project portfolio management prioritization criteria for categorizing projects is stakeholder agreement. It can be made more objective if you add concrete requirements for importance.

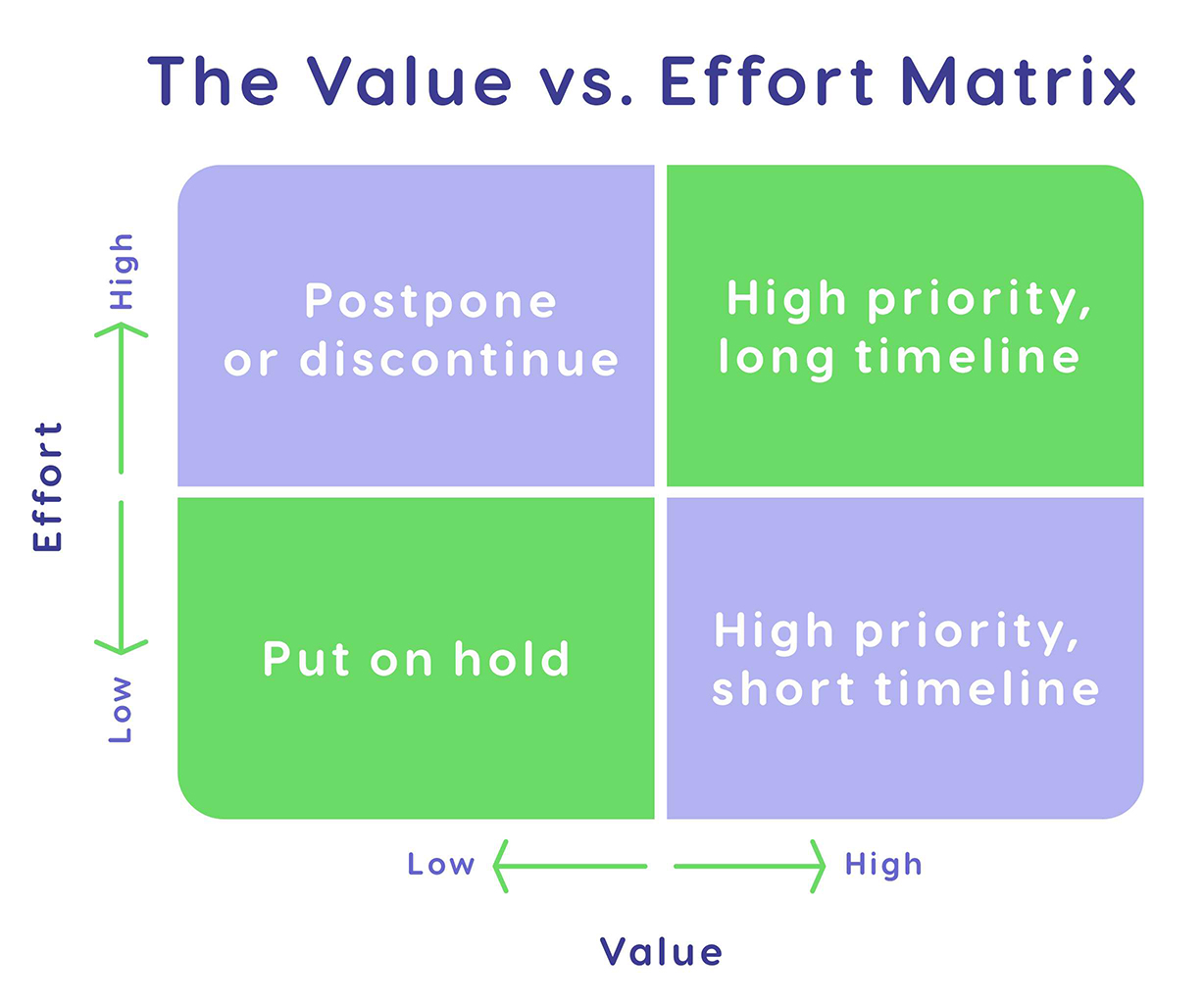

Value-Effort Matrix

The value-effort matrix is a variation of the Eisenhower prioritization matrix for portfolio management with axes being replaced with value and effort. The four categories you can put your projects in are:

- High value, high effort projects. Should be given priority but paced to avoid resource overload.

- High value, low effort projects. Should be given priority as they are quick wins.

- Low value, high effort projects. Should be postponed or discontinued as they waste resources.

- Low value, low effort projects. Should be given low priority.

This portfolio projects prioritization matrix can be more objective if you assign specific portfolio management prioritization criteria for value and effort. For instance, commercial projects can be judged by budget and revenue estimates.

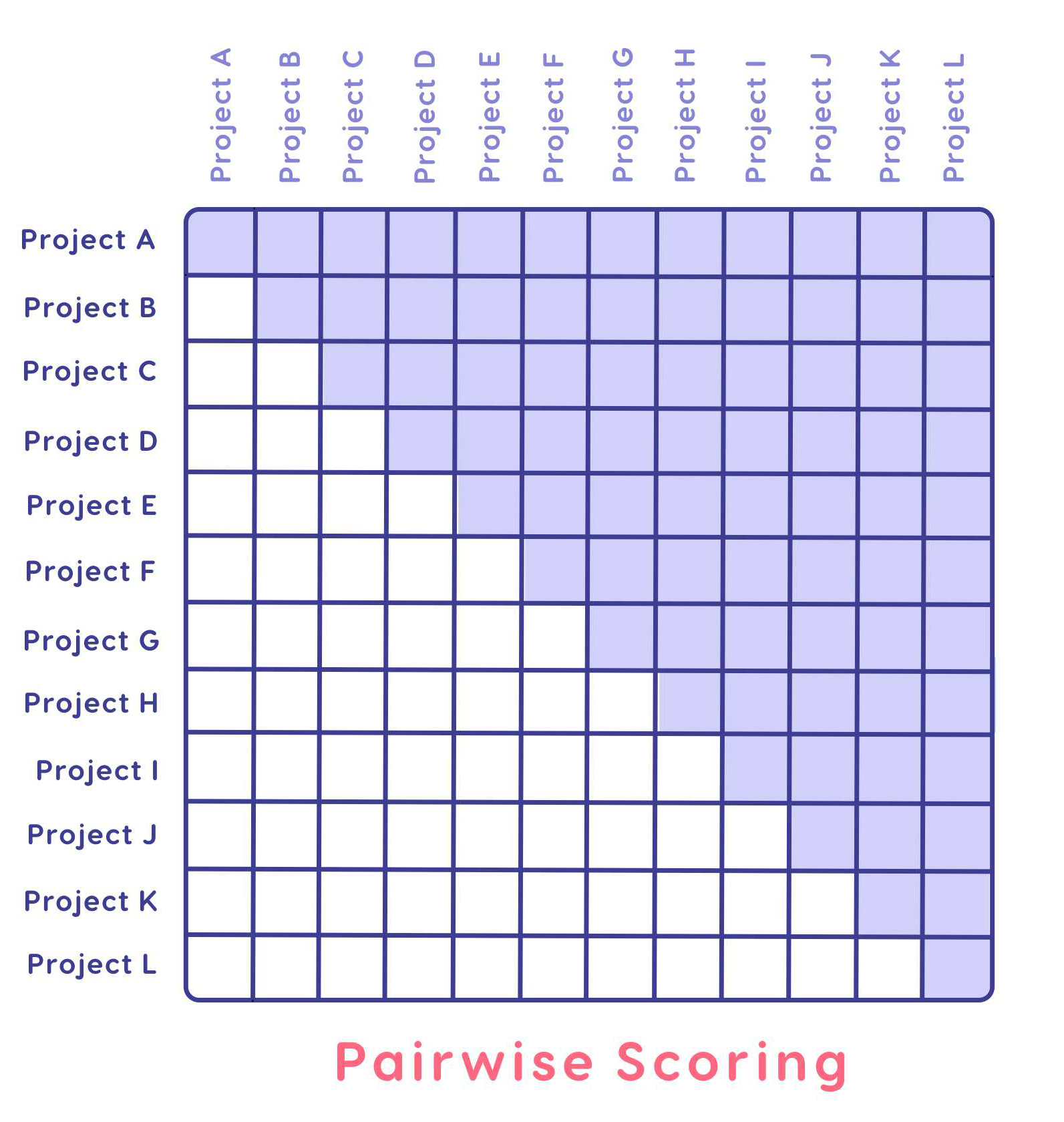

Pairwise Comparisons

This project prioritization method relies on comparing projects between each other through voting. Here’s how it’s done.

- Draw a grid with all of your projects numbered or lettered.

- Take a project pair and discuss which project is stronger.

- The one with ⅔ of votes wins.

- Draw a letter or a number of the winning project in the intersecting cell.

- Repeat for each project pair.

- Count the number of times each project won.

- Sort the projects by that score.

This method provides a more detailed categorization of projects, but can be rather subjective as only opinions of stakeholders or members of the PPM governance board are taken into account.

Scoring Models

Using a scoring model to prioritize projects in your portfolio provides a more detailed and more accurate view of project priority as it combines opinions of the governance board with data. There are multiple models you can use, here is a basic overview of this process as outlined by Augustin Purnus and Constanta-Nicoleta Bodea [1].

- Define scoring criteria. E.g.: revenue and budget projections, strategic alignment.

- Define weights for each criteria. Combined, the weights should add up to 100%.

- Rank each project for each criteria. You can use a Likert scale, percentages, or any other uniform metrics.

- Calculate the final score for each.

- Establish the project priority based on one single score or total score.

The easiest way to decide which projects to keep in the portfolio is to rank them from highest to lowest and keep the highest priority projects that fit the budget.

Cost-Value Analysis

Running a cost-value analysis on the scored projects allows for better prioritization. Instead of keeping the projects that simply fit within the budget, cost-value analysis looks for projects that provide the best value for budget spent.

This analysis presents multiple options of portfolios with different projects included in them on a graph that shows how the overall ROI will be impacted by choosing to keep this or that project.

It’s one of the most data-driven ways to prioritize projects in a portfolio, because it takes into consideration not only the budget, but also resource constraints and business value. However, it relies heavily on data analytics skills to get right.

Operational Necessity

Some projects are non-negotiable, even if their ROI is poor. This is the case for legal compliance processes, for instance. Those should be kept out of the prioritization calculations and should remain in the portfolio for the business to exist.

Make sure you don’t add irrelevant projects to this category, though.

7 Steps To Prioritize A Project Portfolio

Depending on your organization, the scope of PPM, and the resources project portfolio managers have, the prioritization process can look quite differently. Here are the seven basic steps.

Define Strategic Objectives

The first step towards a properly prioritized portfolio is a complete understanding of the organization’s strategic objectives. This allows you to add another element of assessment to the process, especially in organizations that are growing, not simply focusing on maximizing revenue.

Familiarize yourself with strategic documentation of the company or conduct interviews with C-level management to get an update on where the company is going.

Choose The Project Portfolio Prioritization Model

Next, gather the governance board to choose the model you’ll use for portfolio prioritization. You can combine several models or use one model for R&D projects and another one for commercial ones.

Define the Prioritization Criteria

When you know what methodology you’ll be using, define the project portfolio prioritization criteria, assign weights to them, and define scoring ranges. For instance, you can arrive at a set of criteria like this one.

- Potential revenue increase. Weight: 25%. Measurement: 1-5 with 1 being less than $10k and 5 more than $5 million.

- Strategic impact. Weight: 25%. Measurement: 1-5 with 1 being extremely low and 5 extremely high by consensus vote.

- Cost reduction. Weight: 25%. Measurement: 1-5 with 1 being less than 1% and 5 more than 10%.

- Risk factor. Weight: 25%. Measurement: 1-5 with 1 being extremely low and 5 extremely high by consensus vote.

If your prioritization efforts fail, you might have to reevaluate your portfolio prioritization model.

Rank the Projects

Go through your entire portfolio and rank the projects according to the methodology and the criteria you’ve chosen. Run cost-value analytics if you want to use it and exclude projects that are necessary for continuing operations from ranking.

Make Management Decisions

Once you have ranked every project and see a clear hierarchy, decide what to do with them. You may have to assign more resources to the projects with high priority, adjust due dates for projects with lower priority, or decide to discontinue the projects with the lowest priority.

Use scenario planning software to see how different decisions affect portfolio performance.

Confirm Decisions with the Governance Board

Talk to the PPM governance board, project management office, or higher leadership, explain how and why you made decisions on portfolio composition, and present simulation data to them. Once everybody agrees on the changes, implement them.

Monitor & Iterate

Monitor portfolio performance and change your approach depending on the results.

If you find that portfolio performance metrics like lead times lag, you should refine your approach to scheduling and resource capacity planning.

If the portfolio doesn’t produce the expected financial or strategic results, rethink your approach to prioritization methods and criteria.

When you’re creating prioritization criteria, follow this rule of portfolio prioritization:

A project can be approved or ranked as high priority only if its expected business value can be delivered with the available and forecasted resource capacity.

Best Practices For Project Portfolio Prioritization

The portfolio prioritization process defines a large part of portfolio management. Here are the best practices that ensure you do it right.

Manage Stakeholder Expectations

Stakeholder resistance can kill the best project prioritization efforts. If you don’t start managing their expectations early, competing priorities can end up opposing the portfolio you come up with.

Explain that the result of prioritization can be removal of certain projects or postponing them for several months early on. Use analytical data to convince them that the course of action you’re proposing is the right one.

Reduce Subjectivity in Assessments

In portfolio prioritization, it’s impossible to avoid subjectivity. But using prioritization models that only rely on opinions of stakeholders can lead to a distorted understanding of real project priority.

Consider using scoring models that add concrete data to the mix.

Apply Methodologies Consistently

Standardization is important in portfolio prioritization because it allows you to come to a more or less objective view of each project. If you allow bias to be present in the prioritization process, it will distort the view and potentially lead to conflict within the project management office.

Make sure you use your methodology consistently and don’t overestimate the value of projects that one or more people on the team prefer without evidence.

Account for Resource Constraints

During the prioritization process keep in mind that prioritizing projects should not only account for what ideally should be done, but also what can realistically be done. Take your organization’s real capacity in mind, both current and projected capacity levels in the future.

This ensures your prioritization plan is optimized for delivering business value in a realistic manner.

Read more: Resource Capacity Planning: What, Why, and How

Use Analytical Tools

Analytical PPM tools allow you to make more informed decisions on resource allocation and project scheduling. Use PMO software to improve your company’s analytical capabilities and empower your governance board to make better, data-backed decisions.

How Epicflow can Help with Project Prioritization

Let’s look at how PPM software like Epicflow can improve your project prioritization process.

- First, you can set business values in Epicflow and the system will rank all your projects according to their priorities.

- You can use resource capacity planning software to analyze current resource load. Find areas where your resources are overloaded or detect potential overloads in the future. This gives you a better understanding of the organization’s capacity and informs your prioritization choices.

- Use What-If analysis to explore how different portfolio and resource management scenarios impact its overall performance.This will allow you to make data-driven prioritization decisions

- Or you can use EPO, Epicflow Portfolio Optimizer, to arrange your projects and allocate resources for achieving optimum portfolio value with resources available. The projections are based on your company’s current and future resource constraints and the business value projects are estimated to deliver.

Book a call with our team to learn more about how Epicflow can help your organization with project portfolio management.

Conclusion

Proper portfolio management project prioritization can be the difference between a portfolio that only brings resource overload and one that delivers the most impactful projects on time. To prioritize projects in your portfolio well, pick the methodology that suits your goals and capabilities, develop objective criteria to ranking, and apply them consistently.

Use PPM software to balance the portfolio with the new priority data in mind to understand which projects you need to focus on and which you can postpone or remove from the portfolio.

References

1. Augustin Purnus, Constanta-Nicoleta Bodea, Project Prioritization and Portfolio Performance Measurement in Project Oriented Organizations, Procedia – Social and Behavioral Sciences, Volume 119, 2014, Pages 339-348, ISSN 1877-0428, https://doi.org/10.1016/j.sbspro.2014.03.039. (https://www.sciencedirect.com/science/article/pii/S1877042814021302)

Frequently Asked Questions

Why Is effective portfolio prioritization crucial?

Portfolio prioritization is important for every organization because it allows it to understand which projects align with its priorities the most and to focus most efforts on the right ones.

How do organizations implement portfolio prioritization?

To implement portfolio prioritization the right way, you need to define what methodologies you’ll be using, define the criteria in those methodologies, and use real-world data along with voting.

What are the main criteria used in portfolio prioritization?

The set of criteria you’ll use for assessing project priority will differ depending on your company’s strategic goals and access to data. The most common ones are risks associated with the project, revenue forecast, and strategic impact.

When should a company conduct portfolio prioritization?

You should conduct portfolio optimization continuously, once a quarter should be enough for most organizations. You can do an extra round of prioritization when a lot more projects enter the portfolio than normally or when the company’s priorities change.

What is the difference between portfolio prioritization and project prioritization?

These two terms are often used interchangeably and refer to prioritizing projects across the whole portfolio a company has.

What tools and techniques support effective portfolio prioritization?

To do portfolio prioritization effectively, use techniques like the Eisenhower matrix, value-effort matrix, or scoring models. Use AI-based analytical software to improve decision making based on project priority.

How does portfolio prioritization impact resource allocation?

Project prioritization impacts resource allocation decisions because it shows which projects have higher priority and consequently need more resources to deliver them faster.

How can organizations overcome challenges in portfolio prioritization?

Organizations can overcome portfolio prioritization challenges by creating and refining prioritization frameworks, applying them consistently, reducing subjectivity in priority assessment, and using analytical tools.

What are best practices for balancing risk and return during portfolio prioritization?

The best way to do that is analyzing projects across the two axis, risk and business value and ranking them based on that assessment.