Some decades ago, when the manufacturing market was much less competitive, it was a common practice for Chief Financial Officers (CFOs) just to operate costs and ensure project delivery within the budget. But today, it’s no more about financial decision making; the CFO plays a critical role in driving businesses to success, and their responsibilities go far beyond traditional financial strategies.

In this article we’ll focus on the main CFO challenges in the manufacturing industries in great detail and come up with practical tips on how to address them.

Key Takeaways:

- The CFO role has evolved from cost control to strategic leadership with a focus on value creation.

- Manufacturing CFOs operate in an uncertain environment, under conditions of economic volatility, supply chain disruption, regulatory pressure, and talent shortages.

- Delivering profitable growth requires CFOs to align financial strategy with customer value, operational capacity, and long-term business goals.

- CFOs can use digital finance platforms, ERP systems, and AI-driven portfolio management tools to overcome the challenges and ensure sustainable value creation.

The Role of CFOs in Manufacturing Companies

CFOs in manufacturing companies operate under conditions of high uncertainty, constant market, regulatory, and geopolitical changes, and extremely high expectations from executives, clients, and customers. The strategic CFO role and growing responsibilities can’t be denied either. Today’s manufacturing CFOs are responsible for driving value, participate in decision making including operational and strategic decision making, and act as transformation leaders.

This is supported by the results of the survey that says that:

- Over half of CFOs (57%) responded being among the top-leaders influencing strategy development across the organization.

- This expanded influence explains why CFOs started to hold 20% more responsibilities, including risk management (63%) and digital transformation (51.7%).

- The modern state of the CFO’s role emphasizes that now it isn’t about just cost management, it is about proactive leadership.

These results demonstrate the critical need for such specialists in industry as well as how many CFO challenges there are.

Now let’s take a closer look at the main manufacturing companies’ CFO challenges.

Top 9 Manufacturing Companies CFO Challenges

1. Navigating Economic Volatility.

Macroeconomic headwinds have become one of the greatest challenges for today’s CFOs in manufacturing, especially in export-oriented companies where margins are highly sensitive to economic shifts. For instance, 44% of UK CFOs report the level of external uncertainty facing their businesses as high or very high, which is slightly higher than the long-term average. Also, specifically for manufacturing companies, reduced foreign demand becomes a significant risk factor. It makes CFOs manage financial complexity while searching for opportunities to grow and reducing cost spending.

Solutions

To overcome CFO challenges related to economic volatility, finance leaders prioritize tools that boost organizational agility and resilience. The most valuable steps for overcoming manufacturing companies’ CFO challenges are:

- Advanced scenario planning and forecasting. It is a new, sophisticated approach that supports CFOs in decision making under conditions of uncertainty. Forecasting software analyzes real-time data and models different scenarios to predict risks and find optimum ways to prevent or address them.

- Agile governance. CFOs must build more agile governance models to support faster financial decision-making and be more flexible to adapt to the changes quickly.

- Geopolitical risk monitoring. To tackle economic challenges head on, CFOs should stay informed about the latest political and geopolitical news. They also should create contingency plans for unpredicted situations.

Read more: Fighting Uncertainty in Organizations, Including Matrix Ones

2. Driving Enterprise Strategy and Profitable Growth.

In the current economic environment characterized by consistently higher costs and expensive capital, CFOs must meet Chief Executive Officers’ (CEO) expectations to drive profitable growth while maintaining financial discipline and contributing to value creation in the long run. This challenge involves cutting costs by optimizing processes and resource utilization, eliminating waste, and balancing growth ambitions with capital efficiency. The main goal is ensuring that every strategic initiative delivers measurable business value.

Solutions

Delivering profitable growth and meeting shareholder expectations becomes possible with the following measures.

- Prioritizing functions that drive growth. Investing in advanced technologies, sales, corporate IT, and marketing pays off in high customer interest, improved margins, increased brand visibility, more efficient processes, and gaining a new position in the market.

- Strategic resource allocation. Proper finance planning and cash flow management help to cut down on unnecessary spending that leads to overhead expenses. Using a strategic approach, investments can be allocated to initiatives with the highest value potential, increasing the return on investment (ROI).

- Value optimization. Manufacturing organizations aim to implement structured cost optimization alongside value optimization. The latter focuses on cost control, business-oriented analytics, and performance reporting to support enterprise growth and transformation.

3. Supply Chain Disruptions.

Supply chain disruptions have become one of the most pressing CFO challenges, as they are a persistent factor contributing to higher costs and volatility in the manufacturing sector. Today’s global economy is extremely interconnected, and events in one region can snowball into huge shipping costs, changes in regulations, and higher taxes; worsen vendor relationships; cause sudden shortages of raw materials and skilled labor. As was reported by Deloitte Insights, supply chain disruptions are consistently cited as a high-priority risk for finance managers globally, tied for sixth place with geopolitical tensions (21% of responders choose them as a top two risk).

Solutions

For finance leaders, it means not only managing the immediate financial consequences but also rethinking their long-term strategy in two main aspects:

- Diversifying selection of vendors. According to the report, over 15% of CFOs utilize diversification of operations across multiple regions and countries as a response to geopolitical volatility and unexpected disruptions, which highlights the effectiveness of this approach.

- Investing in advanced planning tools. Scenario planning software helps CFOs model multiple “what-if” situations and assess their financial impact in advance. Combining financial simulations with supply chain data helps CFOs assess supplier dependency and evaluate alternative sourcing strategies. This supports more informed decisions, effective risk mitigation and resource allocation.

4. Digital Transformation and Ensuring ROI on AI Investments.

Digital transformation is reshaping the manufacturing sector, bringing new opportunities alongside CFO challenges. A Gartner survey has found that nearly half of CFOs (47%) were planning to increase technology spending by 10% or more in 2025, and it’s no wonder why. KPMG global survey found that the most attractive advantages of using artificial intelligence (AI) and machine learning (ML) in finance are:

- 65% – the ability to predict trends and impacts;

- 60% – real-time insights about risks;

- 57% – increased data accuracy;

- 57% – better data-enhanced decisions;

These findings illustrate that CFOs plan to increase technology adoption of technologies due to their pivotal role in their activities. However, the main challenge isn’t adopting the technology, but ensuring that digital transformation becomes a real business value driver.

Solutions

The solutions listed below will help CFOs overcome the digital transformation challenge.

- Agentic AI for expense management. Agentic AI refers to autonomous or semi-autonomous software systems that can make decisions and work independently to achieve specific predefined goals. For instance, they can be virtual assistants that help CFOs manage budgets, alarm about risks, and automate certain repetitive processes.

- Advanced forecasting and scenario planning software allows CFOs to run different scenarios in the sandbox and see possible risks and outcomes. It enhances the financial decision-making process, allowing professionals to make more considered decisions and solve problems faster.

- Enterprise resource planning (ERP) systems are critically important for finance leaders to implement digital transformation in manufacturing. These platforms provide insight into future resource utilization, cash flow dynamics, and capacity constraints based on historical and real-time data.

Read more: Best AI Project Management Tools in 2026: Comparison & Features

5. Enterprise Risk Management: Navigating Geopolitical Uncertainty and Cybersecurity.

Enterprise risk management (ERM) has become a core responsibility for CFOs, especially in manufacturing organizations that are exposed to global supply chain instability, capital-intensive operations, and regulatory pressure. They are expected to forecast risks, evaluate their financial impact, and support decision making across the entire enterprise.

Geopolitical uncertainty remains one of the most significant risks for manufacturing businesses. Trade restrictions, regional conflicts, sanctions, and energy price volatility directly affect supply chains, production costs, and access to the market. CFOs have to assess a company’s exposure to these risks and work on developing financial resilience under these conditions.

Increasing automation and reliance on digital technologies makes manufacturing companies exposed to cyber risks that can disrupt operations, affect sensitive data, and cause unplanned expenditures.

Solutions

To overcome these CFO challenges effectively, finance leaders should:

- Create a risk register. A risk register is a document with detailed information about potential risks, their possible impact, on-going priorities, and responses. It allows the CFO to identify and track risks and take timely actions to mitigate their influence.

- Invest in technologies. Investment in risk management and cybersecurity helps protect enterprise data, reduce exposure to disruption, and mitigate risks.

- Data security and compliance. CFOs must work closely with IT, legal, and risk teams to ensure that all applications and planning tools meet high security standards and regulatory expectations.

Read more: Managing Risks in Manufacturing Projects: Essentials and Best Practices

6. Balancing Organizational Priorities with ESG Requirements.

In the modern global landscape, CFOs face growing expectations from investors, clients, and regulators to implement ESG principles (Environment, Society, and Government). ESG initiatives often require additional investment and operational changes, making them one of the biggest CFO pain points.

For finance leaders, the challenge isn’t about recognizing the importance of sustainability initiatives, but in combining ESG commitments with other operational and financial priorities. CFOs must ensure that sustainability initiatives support strategic objectives rather than distracting resources from them.

Solutions

One of the ways to address top CFO challenges related to sustainability is finding the right balance between strategy and sustainability. Although ESG practices are important, they cannot be the top priority. So, the CFO prioritizes business strategic goals and rethinks how sustainability efforts can be incorporated. For example, it can be supporting local vendors instead of shipping goods from other countries.

7. Strategic Cost Optimization and Value Management.

Currently, CFOs face the challenge of controlling costs and ensuring that every initiative delivers measurable business value. Value optimization involves linking financial strategies with tangible business outcomes, which will enable manufacturing organizations to maximize ROI and impact of every project on the organizational performance and strategy. At the same time, CFOs should focus on aligning financial management with customer satisfaction, product quality, and growth opportunities.

Solutions

To cut costs and invest more in value, CFOs should:

- Implement lean management methodology. This methodology ensures that processes and projects are focused on delivering value to the end customer. Eliminating waste and addressing customer pain points directly allows organizations to improve operational efficiency (which contributes to cost savings) and customer satisfaction.

- Invest in financial management software. AI-powered solutions have capabilities that allow specialists to address CFO challenges in accounting and financial management. For example, it helps to not only manage budgets but also can predict bottlenecks in finance allocation and make suggestions for improvements.

- Invest in ERP systems. Enterprise resource planning (ERP) systems provide visibility across financial, operational, and human resources. They support cost management through cash flow monitoring, advanced analytics, and scenario planning. This integration helps CFOs make informed decisions that balance cost control with strategic value creation.

Read more: What Is Value Engineering in Project Management? A Complete Guide

8. Managing Regulatory Complexity.

For manufacturing companies, constantly evolving local and international regulations represent one of the most significant CFO challenges. Finance rules are regularly updated to address market shifts, technological advancements, and international agreements, requiring finance leaders to remain flexible and proactive. Failure to comply can result not only in costly penalties but also in reputational damage, which makes regulatory management one of the strategic priorities for CFOs.

Solutions

The best ways to address top CFO challenges in managing complex regulations may involve the following points:

- Delegating compliance responsibilities. The expanded role of CFO doesn’t mean that specialists must do everything on their own. In this case, delegating part of the responsibilities allows finance leaders to focus on strategic decision making, risk management, and value creation.

- Enhanced agility. Managing such fast changes means constantly dealing with uncertainty. Agile or hybrid management methodologies can help companies to solve this problem by improving flexibility and adaptation to evolving requirements.

- Investing in technologies. Investing in AI-driven monitoring tools and specialized platforms enables CFOs to track regulatory updates, geopolitical situation, and market trends. As a result, it can reduce compliance risk, improve decision making and financial governance.

9. Growing Shortage of Financial Professionals.

A persistent “finance talent crash” is one of the core manufacturing companies’ CFO challenges. The Gartner report says that 75% of certified public accountants (CPAs) are going to retire before 2030, while fewer young talents are entering this industry. The number of CPA exam candidates has fallen by 27% over the past decade, and the number of accounting graduates continues to decrease. Also, workforce shortages can be observed not only in finance but also in the other sectors oriented towards the domestic market, like construction and energy, which increases competition for skilled professionals.

Solutions

Here are the ways to address this challenge for manufacturing CFO:

- Embracing AI agents as co-workers and efficient automation technology. Autonomous AI-driven systems are capable of handling financial tasks currently performed by humans. This approach promises huge efficiency gains, allowing companies to reduce the number of issues caused by the human factor and fill the skill gaps.

- Upskill the existing workforce. Organizations should invest in training their employees how to work with innovative tools and advanced analytics. It can be a “bottom-up” approach, where teams start with simple tools and progress to more advanced ones.

- Insourcing talent. Move skilled employees from the other departments into finance roles. It will ensure their career growth and will keep them satisfied while giving CFOs an opportunity to maximize the potential of existing resources.

Manufacturing organizations running complex portfolios should adopt advanced portfolio management software to maximize portfolio value and address the complexity of the financial landscape. The next section provides insight into the capabilities of this software solution in more detail.

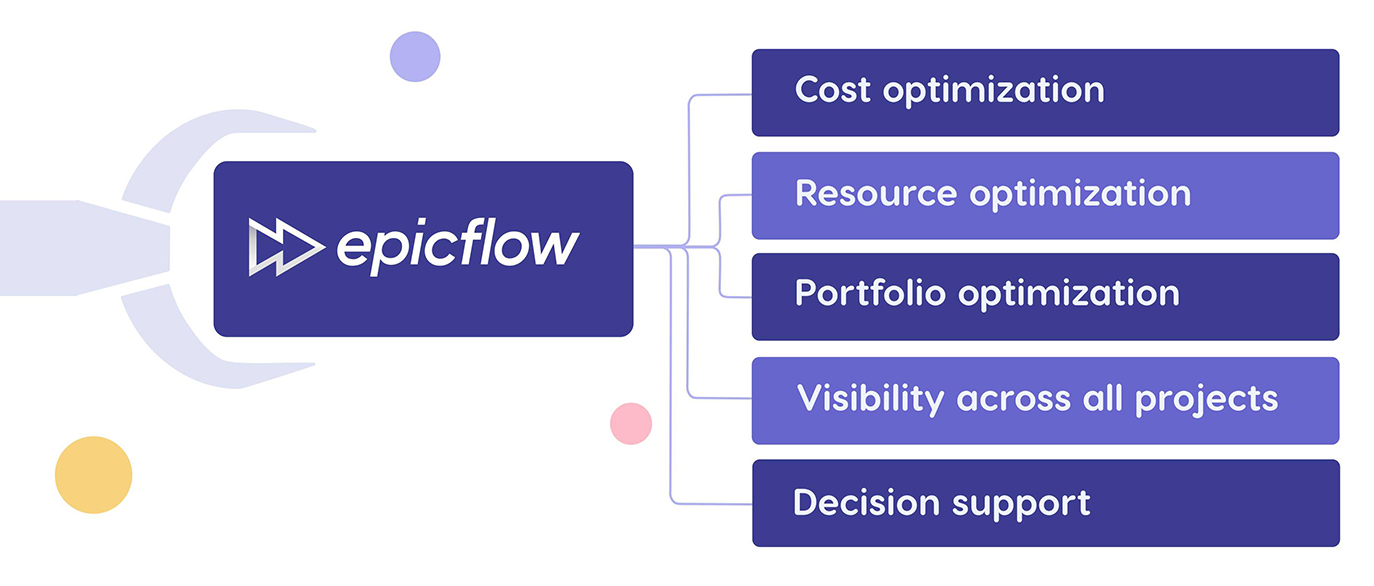

Overcoming CFO Challenges in Manufacturing: Epicflow Solution

Epicflow is an enterprise resource management software that is designed to meet the needs of complex multi-project environments like manufacturing organizations, where financial performance depends on effective resource utilization, cost visibility, and effective decision making. Its main distinguishing feature is powerful AI-powered functionality, which makes it a perfect assistant for addressing CFO challenges and ensuring cost control, forecasting, and portfolio-level visibility. Here are its capabilities in more detail.

Cost optimization.

Epicflow optimizes costs by making the most of the organization’s available resources, preventing and mitigating bottlenecks, and providing end-to-end visibility into and comprehensive control of the entire portfolio, its processes, progress, and resources involved.

Resource optimization.

Epicflow makes sure that available resources are invested in projects driving maximum business value. Its AI-powered capacity planning and resource allocation ensure resource availability and prevent resource shortages, which saves costs and contributes to smooth workflows.

Portfolio optimization.

Epicflow Portfolio Optimizer helps balance limited resources across the portfolio and reschedule projects to maximize portfolio performance and business value with resources currently available to an organization.

Visibility across all projects.

The platform provides full cost visibility across multiple initiatives in a smart dashboard, showing budget planned and spent, allowing CFOs to control it and provide a full picture to stakeholders and other team members.

Decision support.

Epicflow’s scenario planning functionality allows for testing different scenarios predicting risks, and finding proper solutions to address them. This lets senior leaders analyze tradeoffs and make effective management decisions.

Thus, Epicflow supports portfolio managers and senior leaders in optimizing budget and resource allocation across complex project portfolios, enables informed decision making, and maximizes portfolio value. As a result, companies can turn strategy into measurable results. Want to know how Epicflow can support your portfolio and financial management goals? Don’t hesitate to book a conversation with our experts.

Conclusion

The role of the CFO in manufacturing has fundamentally changed. It’s no longer focused on cost reduction; nowadays a CFO is a proactive business leader responsible for driving a company’s growth and profitability. Economic instability, supply chain risks, regulatory complexity, workforce shortages, and rapid technology development are causing challenges for CFOs in manufacturing. Overcoming these difficulties becomes possible thanks to adopting latest technology like agentic AI and advanced software, implementing Agile practices, investing in employee upskilling, optimizing risk management and decision making.

Frequently Asked Questions

What are the top challenges for CFOs?

The main CFO challenges involve:

- Delivering efficient growth in a highly unstable environment.

- Managing geopolitical uncertainty.

- Balancing between reducing costs and strategic investments.

- Compliance with new regulations.

- Retirement of experienced accountants and lack of young talents.

What are the CFO priorities for 2026?

The top priorities for effective CFOs in 2025 include the following points:

- Delivering profitable and efficient growth through business partnership.

- Ensuring ROI with the use of AI in accounting.

- Driving better enterprise data and analytics strategy.

- Improving digital skills of the finance team.

- Reducing overall costs.

What should a CFO focus on?

CFOs should focus on short-term defensive moves as well as long-term strategic initiatives. Key areas which CFOs should focus on in 2026 include such points as:

- Identifying opportunities to grow.

- Manage cash flow and financial complexity.

- Cost and productivity management.

- Work with modern technologies like agentic AI and predictive analysis.

How does a CFO influence strategic decisions?

CFO influences strategic decisions by turning traditional stewardship into proactive business leadership. They help business leaders evaluate trade-offs, prioritize investments, and make informed strategic choices.

How does a CFO manage risk?

CFOs manage risks by identifying, assessing, and quantifying financial threats, incorporating risk considerations into strategic planning and decision making.

How does a CFO drive growth?

CFOs drive growth by aligning financial strategy with business objectives and enabling informed investment decisions. They ensure that resources are directed toward initiatives that deliver business value and profitable growth.