You’ve probably faced the situation when there are numerous projects in the pipeline and they all seem to be important. But the resources are limited, so you need to find the right criteria to prioritize them effectively. Or another situation: upon the project completion, the organization wants to know whether it was worth the money invested.

What do these situations have in common? In both of them, you’ll need to calculate return on investment or ROI – a metric that will help you assess project profitability, set the right priorities, and drive effective decision-making.

Read the article to learn more about ROI in project management, in particular, how to measure ROI, how to interpret the results obtained, and how to maximize it.

Key takeaways:

- Return on investment is an important indicator of projects’ profitability. It shows how much you can get back upon investing a certain sum of money in a project.

- ROI shows what projects are worth investing in, which projects require resources most, and it provides stakeholders with grounds for decision-making.

- Calculating ROI for a project requires two variables: project costs and its expected (or actual) revenue.

- Project management ROI shouldn’t be a single criterion in the prioritization process. Take into account also a project’s strategic alignment, potential risks, and resource capacity.

- Leveraging portfolio management software provides you with opportunities to boost ROI thanks to optimizing resource utilization, eliminating bottlenecks, providing data for comprehensive monitoring and control, and informed decision-making.

What Is ROI in Project Management?

First of all, let’s make sense of ROI meaning in project management. Return on investment (or ROI) demonstrates the profitability of a project delivered. In other words, it shows how much you will earn back upon investing a certain sum of money. As a rule, it’s the ratio of the net gain (or loss in some cases) to the invested funds, which is expressed in percent.

How do you calculate project management ROI? We’ll show you the formula in the next section.

How to determine ROI on a project: The basic project ROI formula

Before proceeding to the project ROI calculator, let’s consider the formula for basic ROI calculation. This is how ROI is calculated in business:

In project management, Net Profit or Net Gain is the difference between the financial value gained upon project completion and investment costs. So, ROI formula in project management will look a bit different:

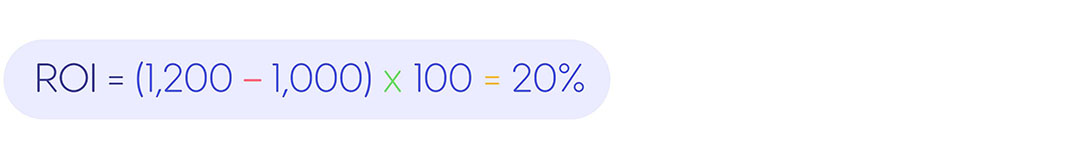

Let’s imagine one of the most straightforward ROI examples. You’ve invested $1,000 in a project and gained $1,200 upon its completion. You can calculate ROI formula in the following way:

However, knowing the right formula is not enough to make the right decision. You need to know how to interpret the result of your calculations.

3 Types of ROI and What They Mean for Your Project

So, here are 3 main types of project ROI, their impact on your projects, and what to do about them.

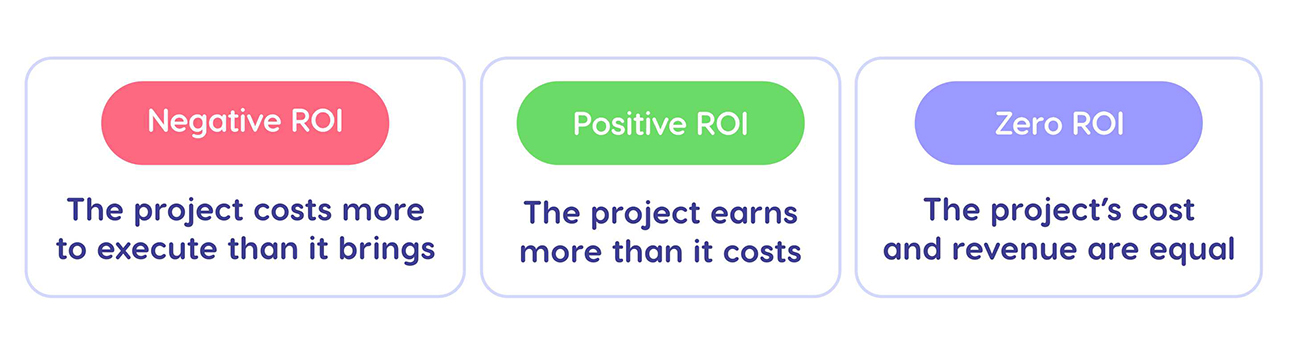

1. Negative ROI.

If the ROI metric you’ve calculated is expressed by a negative figure (less than one), the project will not generate any financial value. The costs outweigh the revenue, which means that a project will deliver no financial gain. This can happen for numerous reasons: poor resource management, scope creep, bottlenecks and delays, poor planning, external factors, etc.

Though this result is rather disappointing, it gives you a chance to assess the effectiveness of your project and resource management processes. If it’s not caused by external factors, you should find the root cause of this problem and fix it before other projects fall into the same trap. For example, you can use portfolio management tools to identify bottlenecks that caused delays and increased project costs.

It’s also worth noting that projects with negative ROI shouldn’t always be terminated. It depends on different factors. For example, if this project has a high strategic value, it’s reasonable to consider taking corrective action to return it on the right track.

2. Positive ROI.

When the value of your calculations is higher than one, the expected project return on investment is considered positive. In other words, you’ll gain profit upon project completion. That’s undoubtedly good news, but you should still keep your nose to the ground.

- First, you should continuously monitor project progress and resource performance to make sure that your portfolio is doing well.

- Second, it’s a good idea to analyze what factors led to positive results: maybe, you’ve managed to cut lead times or optimized resource utilization? Knowing this will help you replicate success for future projects. You can also develop some best practices and share them with other project teams or departments of your organization.

Now, you may ask, “What is a good ROI for a project?” Generally accepted “good” ROI for a project is higher than 10%. It may vary depending on the industry, type of a project, risk factors, and other parameters. And finally, ROI shouldn’t be considered separately, without other indicators (e.g., a project’s strategic alignment).

3. Zero ROI.

Sometimes, the results of ROI calculation equal zero. This controversial result means that you neither lose money, nor gain. The project generates the same return as you’ve invested in it. Though it may not seem as bad as negative project ROI, it signalizes that some processes need to be revisited and adjusted. For example, you can check the following things:

- Resource performance;

- Project progress;

- Budget consumption;

- Initial project estimates;

- A project’s strategic value.

The analysis of these factors may be helpful to find the cause of not gaining the expected revenue and spot areas for improvement. Also, it will help you decide on further actions — whether you should continue this project upon eliminating inefficiencies, make adjustments (and what exactly), or stop it.

Now, let’s dwell on the importance of ROI in project management.

Benefits of Calculating ROI in Project Management

Let’s imagine an IT company running multiple projects with a shared resource pool. Its management thinks of taking one more project, as it’s potentially profitable. Why does an IT project manager need to consider a project’s return on investment (ROI) before starting a new project? This calculation will help them and other stakeholders understand whether this new project will justify the invested time and resources (both human and financial). What is more, as resources are limited, they need to allocate them to projects that will pay off most. And this is where calculating and tracking project ROI will help you make the right decisions.

Therefore, calculating ROI of a project serves as a measure of potential revenue generated by it. And this parameter can be used for making further decisions, especially when you need to manage multiple projects with limited resources. Let’s review the benefits of ROI calculation in more detail.

- It provides grounds for project prioritization: When all projects seem to be equally important, you can rely on their ROI when prioritizing them.

- It provides an opportunity to distribute resources more effectively: You can allocate resources to projects that will generate more revenue.

- It helps you make decisions: Analyzing projects’ ROI will help you decide on further actions regarding these projects, e.g., taking corrective action, proceeding or terminating a project if necessary.

- It shows financial performance: Comparing expected and actual ROI can provide you with useful insight into the effectiveness of project and resource management in general and cost management in particular.

- It’s a valuable parameter for stakeholders: For example, before starting a project, they will naturally want to know what financial benefits they’ll get upon its completion.

As we see, ROI is a useful tool for effective project portfolio management process.

Read more: Optimizing Portfolio Profit Through DIPP-Guided Resource Allocation

How to Estimate Net Profit of a New Project

Calculating ROI of a project that you have already completed is easy. You already know exactly how much budget is spent on the project and how much monetary value it has brought. Even with projects that don’t bring in the final monetary value from the start, you can estimate how much value it will generate based on the first months of growth.

But how do you project the ROI of a project that is yet to begin? You need to get back to how ROI is calculated in project management and estimate the components of the ROI formula.

- Estimate project costs. Gather with your team and decide how many billable hours the project takes. You can add other expenses like weighted office rent cost or an expected margin of error if you want to be more precise.

- Estimate project financial value. This can be more straightforward with client projects where you’ve agreed on a set sum. Other types of projects might require more complicated calculations.

- Estimate net profit. Subtract project costs from financial value.

Now, let’s look at an ROI calculation example. Let’s say you do portfolio management for an automotive company and the board wants to invest in an app that allows users to build their ideal car from factory options.

- Your IT team estimates it will take 3 months to build it.

- With a team of 5 and an average pay of $30/hour that comes up to 2400 hours or $72.000.

- From past data, you know that IT estimates can be off by up to 10%.

- Since it’s a new project, you assume the 10% figure and costs come up to $79.200.

- From focus groups, you know that people in a higher income bracket are willing to pay more for custom cars and will prefer them to stock vehicles.

- Based on sales department statistics, you estimate the added revenue to be $120.000 annually.

- Net revenue comes up to $40.800 if calculated for one year.

In the next section, you’ll learn how to calculate project ROI in five simple steps.

How to Calculate the ROI for a Project: Step-by-Step Guide

Though the formula for calculating ROI is rather simple, we’d like to provide guidance on the whole calculation process and take into account all key factors.

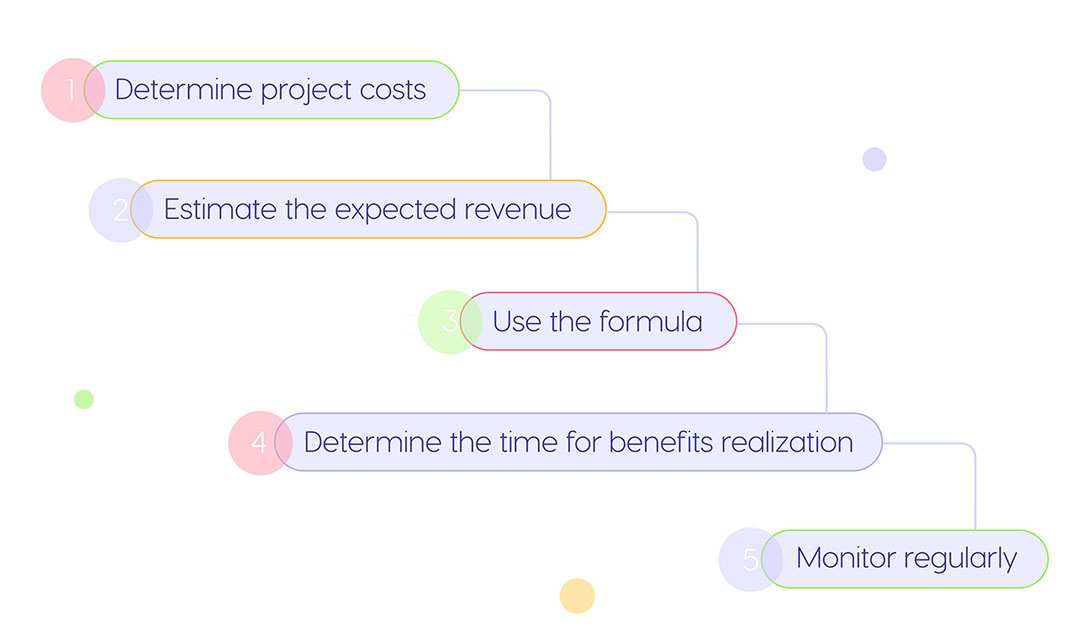

Step 1. Determine project costs.

This is one of the variables from the ROI calculation formula, so you need to pay close attention to it, and make sure it’s as accurate as possible. For most precise cost estimation, take into account all spendings: labor, equipment, facilities, tools, software, raw materials, training for employees, etc. Also, you should take into account the project duration, as it will directly impact project expenses.

Step 2. Estimate the expected revenue.

Though some of the benefits of project completion may have intangible results (for example, saving time, increasing productivity), it’s better to determine their financial equivalent. For example, upon improving the productivity of existing employees, you’ll save money for hiring new people or outsourcing them. So, this saved amount of money can be added to the project revenue.

Step 3. Use the formula.

Now, it’s time to put the above-mentioned estimates in a formula and find out ROI of the project.

Step 4. Determine the time for benefits realization.

In some projects, you get immediate value upon their completion, while the benefits of others can be realized within a longer period of time. This is why you should determine the time frame for evaluating how well the project has paid off.

Step 5. Monitor regularly.

Monitoring all aspects of a project is a must, but it gains particular importance for long-term projects. Why? Because we may face diverse changes in both external and external factors. For example, the prices for raw materials or equipment may increase, the number of human resources may change, etc. These factors will inevitably affect project cost and expected ROI.

In addition, it’s critically important to regularly monitor resource performance – it will help you early detect possible bottlenecks and avoid delays and cost overrun.

Read more: Tracking Performance: Switching from Project to Resource Level

Prioritizing Projects Based on ROI: Useful Recommendations

Obviously, ROI is a powerful prioritization criterion you can use in your project portfolio management practice. Though seemingly straightforward, merely calculating ROI for every project in the portfolio and ranking them accordingly isn’t enough. You need to take some more aspects into account:

- Consider the time for benefits realization (remember that some projects don’t deliver immediate value);

- Determine projects’ strategic alignment: It’s not a good idea to implement projects that don’t match your organization’s strategy, even if they have potential for high ROI;

- Take risks into account: If a project is too risky, this can neutralize its high ROI potential and instead of generating profit, it will require more funds to mitigate risks.

- Don’t neglect resource capacity: This is probably the most important factor. Resource constraints make it impossible to implement projects even with the highest ROI. For example, if you’re considering starting a project with a high ROI potential, you should first of all make sure that you have enough resources to implement it and deliver existing projects successfully.

As we see, relying only on ROI for prioritization of projects in the portfolio is not enough. To set priorities in a really effective way, you should analyze ROI in combination with other criteria.

Maximizing Project ROI with Epicflow

Every business organization strives to maximize the project management ROI. And this is not mission impossible. Using the right portfolio management software will make this task quite manageable.

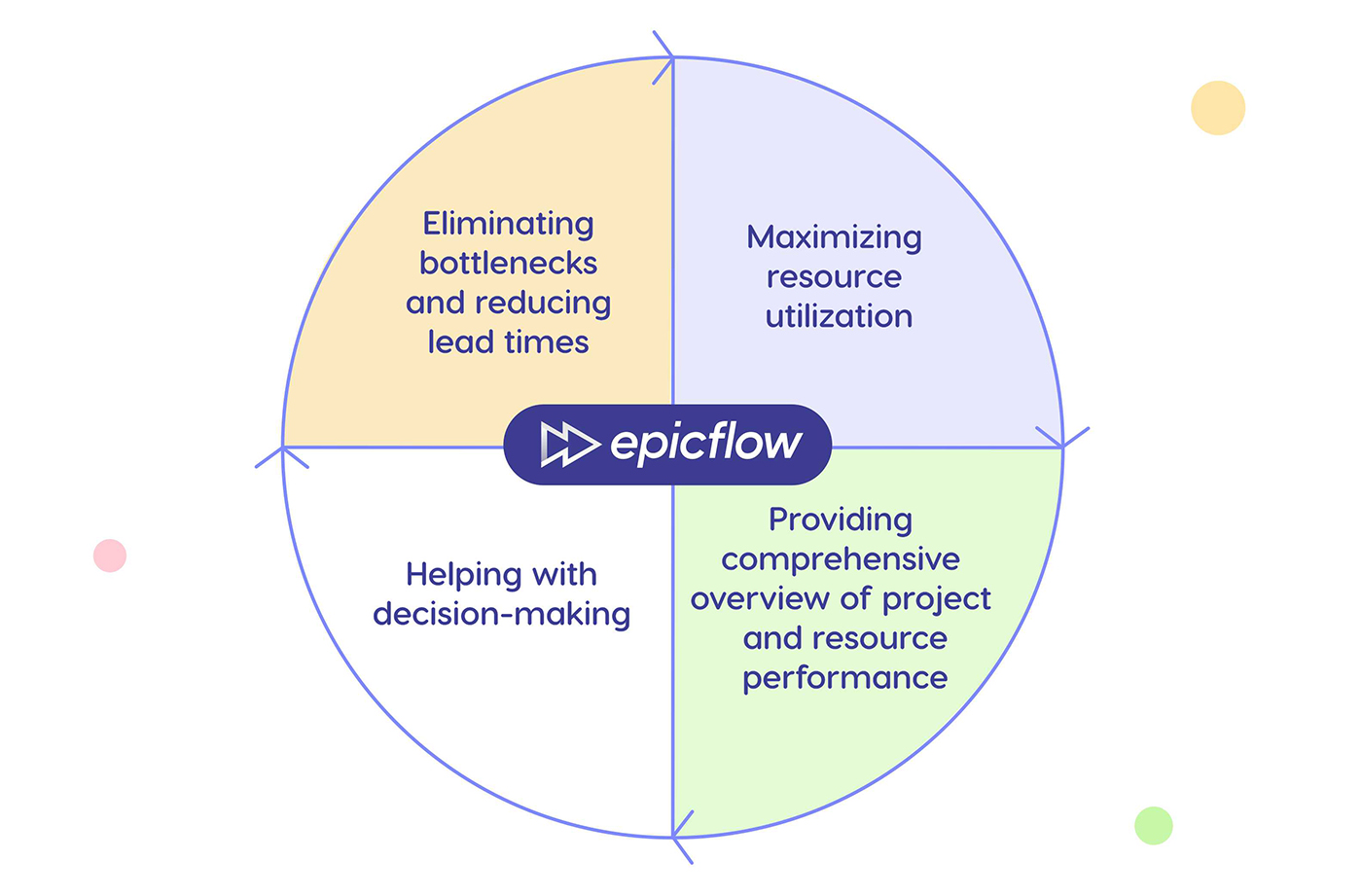

We’d like to tell you about Epicflow, a portfolio and resource management tool that will help you get maximum benefits of undertaking a project, including multiple complex projects. How does it do that?

Eliminating bottlenecks and reducing lead times

One of the superpowers of Epicflow is the ability to fight bottlenecks. In particular, it helps you forecast future bottlenecks and identify the existing ones. Also, it can show what causes these bottlenecks, which is really important to know if you want to eliminate them. But wait, there’s more. Its scenario analysis tool will allow you to test the best possible ways of resolving a bottleneck.

What does it have to do with increasing ROI? No bottlenecks mean smooth project workflows, increased productivity, less probability of delays and going beyond the budget. Bottleneck-free workflow reduces lead times, which means faster delivery which is a great plus for maximizing return on investment.

Maximizing resource utilization

The other essential focus of Epicflow’s functionality is on achieving efficiency and productivity of resources involved in multiple projects at the same time. Here are its capabilities that serve this purpose:

- Wise resource allocation based on skill levels, capacity, availability, experience, etc.;

- Effective capacity planning driven by predictive analytics;

- Intelligent workload management that prevents people of overloads and balances uneven workloads across multiple projects;

- Smart resource performance analysis which is a basis for assessing the entire portfolio’s health.

All these capabilities contribute to increasing resources’ productivity and their efficient utilization as well as help avoid unexpected costs. This is another contribution to boosting ROI for a project.

Providing comprehensive overview of project and resource performance

Increasing return on investment is impossible without regular portfolio monitoring and control. Epicflow provides you with multi-sided monitoring capabilities. First, you can track resource performance and assess how productive they’ve been. Secondly, you can monitor the state of the whole project portfolio, get insights into project performance, know which projects are doing well and which require corrective actions. In addition, you can track budget and manage budget consumption to make sure that your project doesn’t go beyond the budget frames.

Helping with decision-making

Making decisions in project management is tough, especially when you work on multiple projects with diverse dependencies and under conditions of uncertainty. But Epicflow can change the game. Its What-if analysis helps you test different scenarios and find an optimum way of addressing risks and bottlenecks in the workflow. The result? Reasonable decisions, better productivity, and opportunity to enhance ROI for a project.

Read more: Fighting Uncertainty in Organizations, Including Matrix Ones

By the way, one of our clients, a department of the large defense company based in the UK, has managed to increase its revenue by 10% without investing in more resources. Just by reorganizing resources’ work and eliminating bottlenecks, they’ve revealed the potential to undertake more projects. Read more in our case study:

Unlocking a Defense Company’s Potential to Complete More Projects

Conclusions

Calculating project ROI can help you understand the potential value it can bring to the company in a more nuanced way — as a proportion of value to investment. It’s not the only calculation you should be using to determine project priority, but it’s a very important one, especially for commercial projects.

Use projections of project budget and revenue to calculate ROI, and use portfolio management tools to organize the portfolio in a way that prioritizes projects with the highest business value, whether that’s ROI or strategic value.

Frequently Asked Questions

What is the ROI of a project?

Basically, return on investment or ROI indicates how much money you can return back upon making an investment. In project management, ROI is a metric used to evaluate profitability of a project. It’s the ratio of net profit gained upon project completion to the sum of money invested in it.

How to calculate ROI in project management?

To calculate return on investment for a project, you need two variables: project costs (actual or estimated) and financial value this project has delivered (or is expected to deliver). Then, use the following formula for ROI calculation:

ROI = (Financial value – Project cost / Project cost) x 100%.

The result you’ll get will tell how profitable the project is.

What are 3 types of ROI?

There are three types of ROI you can obtain upon calculation:

- Positive project ROI means that the revenue gained upon project completion is higher than costs invested in it;

- Zero ROI means that the generated revenue equals costs invested;

- Negative ROI will tell you that project costs are higher than the financial value it has delivered.

What is a good ROI percentage for a project?

For an average middle-sized organization, a good ROI estimation would be around 10%. Anything above that is possible either at organizations with low overhead or for rare projects.

How is Return on Investment (ROI) used?

Calculation of ROI in project management is important for understanding the value of projects in a portfolio. Knowing projected ROI values helps project managers prioritize projects that bring in the most value for the least amount of effort and increase company revenue.

However, the formula for ROI can’t help you figure out the potential value of some projects. Research and development is one notable example. Despite not bringing monetary value to the organization, it often brings in innovation that can be monetized later. In cases like these, instead of asking yourself how to compute ROI, you’d be better off focusing on other metrics.

How do you calculate ROI for a 5 year project?

To calculate ROI for a project that keeps bringing in value over several years and requires maintenance, you’ll need to add upkeep costs to the calculations and annualize the returns. Use a formula like this:

ROI = (Estimated Annual Revenue)/(Initial Investment + Annual Maintenance Cost)