In this article, we’ll take a closer look at what R&D portfolio management is, what it takes to manage an R&D portfolio well, and how to overcome its main challenges.

Key takeaways:

- R&D portfolio management relies heavily on estimating business impact of projects.

- It requires more risk management than managing an average portfolio.

- Effective management boils down to developing frameworks of value estimation and rationalization based on business value.

What Is R&D Portfolio Management?

R&D portfolio management is a part of PPM activities that aims to select, plan, and oversee research and development projects in your organization’s portfolio. Its main goal is to ensure the investment in innovation aligns with organizational goals and that neither innovation nor market-oriented activities hurt each other in the portfolio.

To manage a portfolio of R&D projects, PMOs use prioritization frameworks and portfolio management software.

In an average R&D portfolio, you’ll find two main types of projects: basic or fundamental, and applied. Fundamental projects are a lot less defined and aimed at researching a new technology, like a new type of chemical formula.

Applied projects seek to find a practical application to the company’s research findings. They can be further broken down into applying new technology and incremental changes to the existing one.

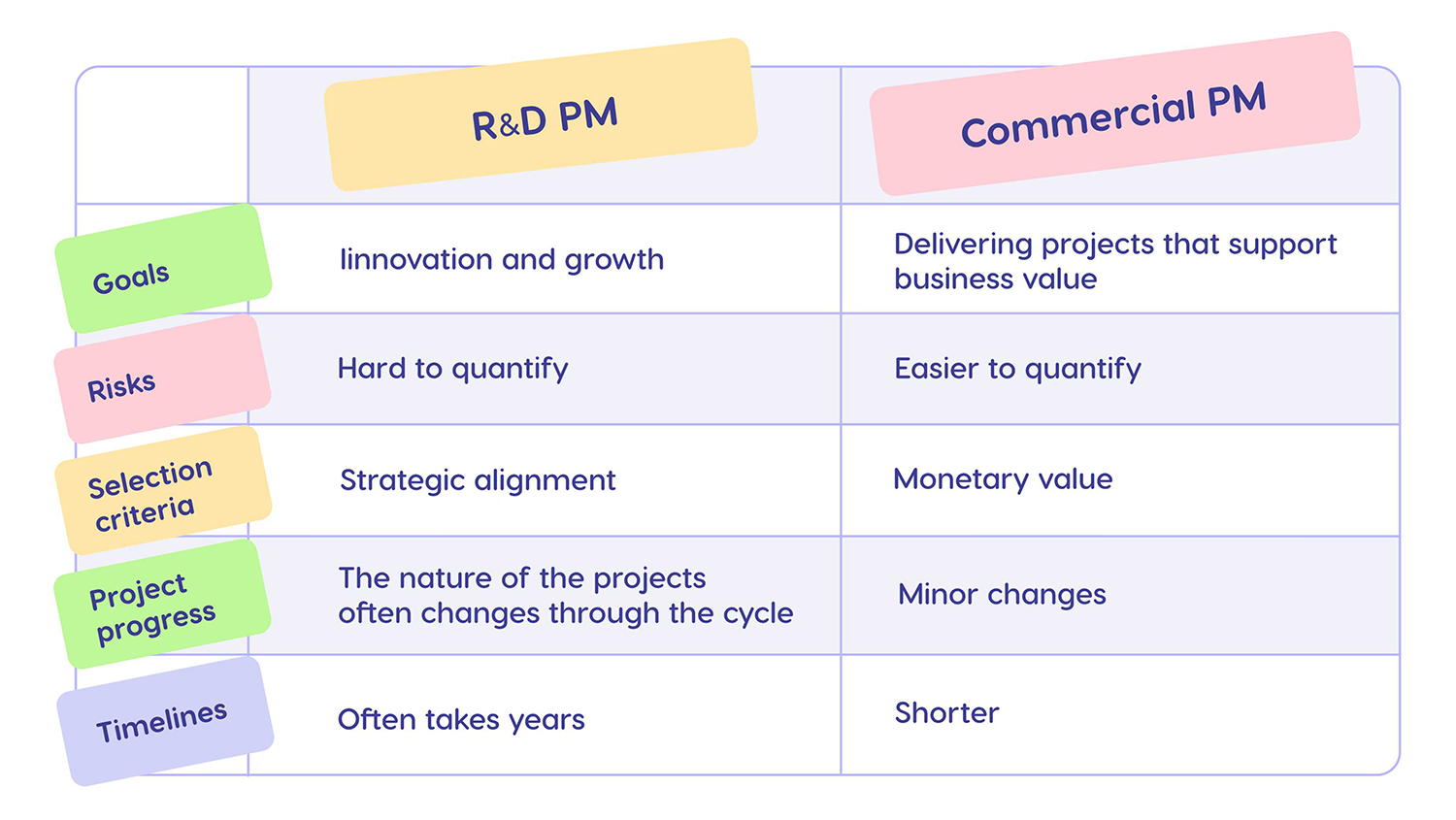

What is the Difference Between R&D and Project Portfolio Management

As R&D portfolio management is a part of a larger portfolio management framework, a lot of activities and methodologies are similar:

- Prioritizing projects.

- Resource allocation.

- Project staggering.

- Analyzing portfolio performance.

But research and development is inherently different from market-oriented work, which influences its management process. Here are the core differences between the two.

Benefits of Effective R&D Portfolio Management

Research and development rarely produces business results right away. It may take years to go from an idea to a product in this process. However, it’s one of the only things that can help you stand out from the competitors in most niches, and the only thing that keeps you competitive in some.

When applied well, R&D portfolio management can help you to:

- Balance capacity between R&D and commercial projects. Use PPM software to reallocate resources based on your company’s long term strategy, and you will have a balance between keeping the company in the black and evolving it.

- Focus on the R&D projects that matter. Correct prioritization lets you focus the limited resources you have on R&D projects with the highest business impact.

- Innovate and lead the market. Producing innovative products is what separates leaders from followers. It generates publicity that doesn’t require investment and brings customers in.

- Remain competitive. In some niches, like in the pharmaceutical industry or aerospace and defence, R&D is what drives growth and lets companies remain relevant.

R&D Portfolio Management Strategies

How do you prioritize different types of R&D projects? That’s determined by your strategy which aligns with business objectives. Here are a few options for R&D portfolio management and tech advancement prioritization:

- Balanced R&D. A balanced R&D portfolio aims at distributing efforts between the types of research evenly.

- Technology leadership. A risk-taking R&D strategy that aims for large-scale innovation in hopes of dominating the market.

- Risk minimization. The inverse of the previous one, this strategy focuses on incremental changes to hedge the inherent risks of R&D.

- Serving the market. This strategy is to organize R&D portfolios in accordance with customer research and requests, not to realize a grand vision.

These strategies are not set in stone, of course. You can think of them as a graph with two axes, one being risk-taking and the other market-orientedness. With all business goals accounted for, most companies will have no trouble finding a spot that’s best for them on this spectrum.

Key Challenges in R&D Portfolio Management

Apart from the regular PMO challenges common for most portfolio managers, R&D portfolio and project management has a number of unique problems. Here are the main ones.

Budget-Oriented Thinking

Far too many organizations both big and small tend to fall into thinking that budget is the primary constraint and primary driver of a portfolio. If a brilliant new R&D idea comes up, it’s easy to think your organization cannot handle it because there’s no budget for it currently. Inversely, it’s also easy to approve projects that might not bring the most value as long as there’s a budget for it.

Combatting this limiting belief in an organization is not a simple story, but the alternative can greatly improve business outcomes. Instead of using budget constraints, focus on managing the portfolio based on two simple factors: how much business value do R&D projects drive, and whether your organization has resources for the execution.

Stakeholder Bias

Even when the numbers paint a certain picture, some stakeholders might not take that into account. It can take the form of a stakeholder insisting on a project’s execution because it has personal significance for them or because they believe it will play into company politics. It can also take the form of stakeholders being averse to risk taking even though it seems justified.

If that’s the case in your organization, it will take a combination of analytical data and interpersonal skills to convince the stakeholders.

Balancing Budgets and Resources Between R&D and Business Projects

Most companies that have R&D processes also run a large portfolio or market-driven projects. If the personnel can easily be changed between the two, the question of resource allocation arises.

Your decision making process should take project priorities of the whole portfolio into account to ensure both commercial and innovational projects get delivered on time.

Predicting Business Impact & Prioritization

Predicting the business impact of R&D projects, especially with fundamental research, is not an easy task. If you wrongly estimate the real value of a research project, you can either lose a major opportunity or waste budget on something that becomes an IP with no clear real-world application.

Use a combination of predictive analytics, portfolio management tools, and stakeholder interviews to estimate and assign value to your R&D projects

R&D Portfolio Management Process in 8 Steps

These R&D portfolio management best practices will help you prioritize and optimize your research projects.

Understand Organizational Goals

The key to succeeding in managing an R&D portfolio is aligning it with your company goals. So the first thing you should do is understand them in as much detail as possible. Review strategic documentation and interview the C-level management if necessary. This will help you to:

- Establish a high-level understanding of the company strategy.

- Establish key R&D objectives.

- Establish the expected timelines.

- Define key performance metrics for portfolio performance evaluation.

That’s the foundation of the PPM process, the rest of it is aligning the portfolio with company strategy and managing timely execution of prioritized projects.

Inventorize Current Portfolio

The next step is to take inventory of your R&D portfolio. You need to understand:

- What projects are currently being executed.

- What is their status.

- Are there bottlenecks or blockers in project execution.

- What projects are planned for the future.

- What projects are on hold.

- What is the R&D talent structure and composition.

- How are they currently allocated.

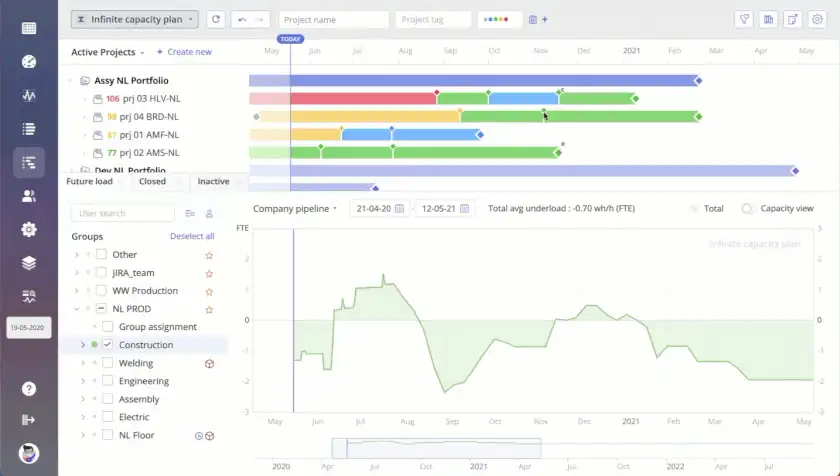

If you’re using PMO software, this step should be easy, as tools like Epicflow help you visualize the whole portfolio and go through it task by task, resource by resource.

Review Project Priority

Once everything is accounted for, review how projects are prioritized in the pipeline currently and align them with your strategy if needed. First, you’ll need to understand whether there is a clear framework for project prioritization in place. If there isn’t, you’ll need to create one with the stakeholders.

For applied R&D, a project’s priority often can be boiled down to expected monetary value. For instance, a project can be expected to reduce production costs by 8%. These cost savings calculated for several years and combined with the budget spent on research produce an ROI sentiment. You can also add a weighted risk factor to your calculations.

Calculated ROI for basic early-stage research is almost impossible, so measuring business impact can be a good alternative. Work with stakeholders to develop a list of business areas R&D impacts, and vote on how much any given early-stage project may impact a business area.

These two project types should be balanced according to the strategy your company pursues. You can either go through projects and vote on them one by one with CXOs or apply a weighted multiplier to your calculations.

When you have developed a framework, apply it to the R&D portfolio to see which projects aren’t aligned with your priorities. A tool like an AI-driven portfolio optimizer can help you organize projects by priority automatically.

Review Project Feasibility

Some projects are a great idea in terms of business value, but can’t be done with the resources your organization has at the moment. To determine that, run a feasibility study. Through analyzing the portfolio with workload management software and conducting interviews with team experts, determine:

- Does the company have the right mix of talent to execute a project successfully?

- Does the company have the right financial resources for it?

- Is it possible to complete the project with the given time and budget constraints.?

- Will the R&D project be valuable on the market?

Develop Portfolio Scenarios

With all the input data ready, you can start to create different scenarios of your portfolio with the aim of finding the optimal one. Use what-if analysis to simulate how your portfolio would perform if you change different variables. You can alter:

- Project start and end dates.

- How many resources are allocated to each project.

- Which skilled resources are allocated.

Run several simulations and find the one that ensures the high-priority projects are delivered on time and little to none are over the allocated budget.

Prioritize

Based on the simulations, prioritize the projects in your portfolio in an optimal way. This, however, may prove to be harder than communicating the changes to the teams as you’ll need to get a green light from the company executives. Here’s what this process might look like:

- You review your production company’s portfolio in manufacturing project management software.

- Your R&D strategy is balancing short and long term innovations with a strong market-centric focus.

- You find that one project that’s taking 15% of resource capacity from the R&D team is focused on fundamental research for a new product.

- You trace it back to a stakeholder with a slightly different view of the company’s goals.

- You present simulation data to them and convince them to bring up the need to alter the strategy and continue the project on the next strategy meeting.

- You put the project on hold and free up 15% of capacity for applied research aligned with the strategy.

If everybody agrees on the rationale behind your work, shift project timelines according to your plan.

Allocate Resources

Depending on your analysis, you may need to reallocate the resources assigned to projects in your portfolio. You can either reassign some of the talent from less important projects to the more important ones or borrow resources from market-driven projects if that’s possible.

Measure Performance & Iterate

After the changes are implemented, monitor both portfolio performance and the financial impact of R&D projects. If everything goes according to plan, proceed with your current framework. If you see problems in one of the two areas, analyze why that is happening.

You might need to shift some of the projects or resources around to have the most important research done on the budget. You might also have to rethink your approach completely, depending on the nature of the problem.

KPIs for R&D Portfolio Management

To understand whether your efforts are improving the portfolio, you need to measure its performance. Measure it across two dimensions: portfolio and R&D success. The exact set of KPIs should depend on your company goals. Here are some PMO KPIs you can track:

- Project success rate

- Resource utilization

- Budget variance

- Schedule variance

- Strategic alignment KPIs

- Benefits realization

- Risk response time

If these don’t improve in your portfolio, it’s a sign of poor day-to-day management.

To assess R&D performance, you can track:

- R&D Expenditure as Percentage of Sales

- Return on investment

- Time to Market

- Commercialization Success Rate

- Innovation Rate

If these are not improving and you don’t see business benefits from R&D investment, you’ll need to rethink your prioritization framework or R&D strategy.

Best Practices for World-Class R&D Portfolio Management

Managing a project portfolio of R&D initiatives requires strategic alignment with business priorities, a good rapport with the stakeholders, and management capabilities of a PMO. Here are a few best practices in more detail.

Choosing the right strategy

A lot of R&D success depends on your priorities as an organization. If the priorities you’ve chosen do not fit either your resource pool or your market position, no amount of proper management can make your business grow.

It is a strategic decision on a level higher than the project management office, but choosing the right R&D strategy is crucial for the whole operation.

Business impact calculations

Assigning project priority within the portfolio relies on an accurate understanding of the benefits an R&D project can bring. This requires accurate estimates of its business impact, either in monetary terms, or as a projection based on voting.

Creating frameworks for these estimates and revising them regularly helps with correct prioritization.

Standardization practices

Arbitrary decision-making cannot be improved because if it doesn’t perform well, you can’t possibly know what exactly went wrong. Standardize every step of R&D portfolio management, from prioritization criteria to resource allocation and set people who are responsible for them.

This way, when you see the portfolio underperforming, you can fall back to those standards and either find what deviated from them, or revise the standards.

Examples of R&D Portfolio Management in Different Industries

Let’s look at a couple of examples of R&D portfolio management and the results it can bring.

Dutch Ministry of Defence

Dutch MoD turned to Epicflow to solve the problems that were plaguing their $1B portfolio: an overabundance of projects, resource overload, and decision-making process influenced by budget first. After analyzing the portfolio and developing clear prioritization criteria, the organization was able to:

- Reduce lead times by over 30%.

- Grow the expected due date performance from 24% to 77%

- Deliver high-priority projects 424 days earlier than expected.

TKF

TKF is a Dutch telecommunications company that faced productivity issues in the R&D department. The main problem was that 18 engineers had to manage 75 active projects. This resulted in a resource overload and little to no projects delivered on time.

TKF turned to Epicflow for help. With the help of pipeline analysis, they found that their R&D resources were engaged at double the capacity. Prioritizing the projects and putting half of them on hold allowed them to:

- Increase the number of delivered projects from 25 to 48 annually in the first year.

- Grow that number to 98 in three years with the resource pool staying the same.

- Cut lead times from 18 to 4 months.

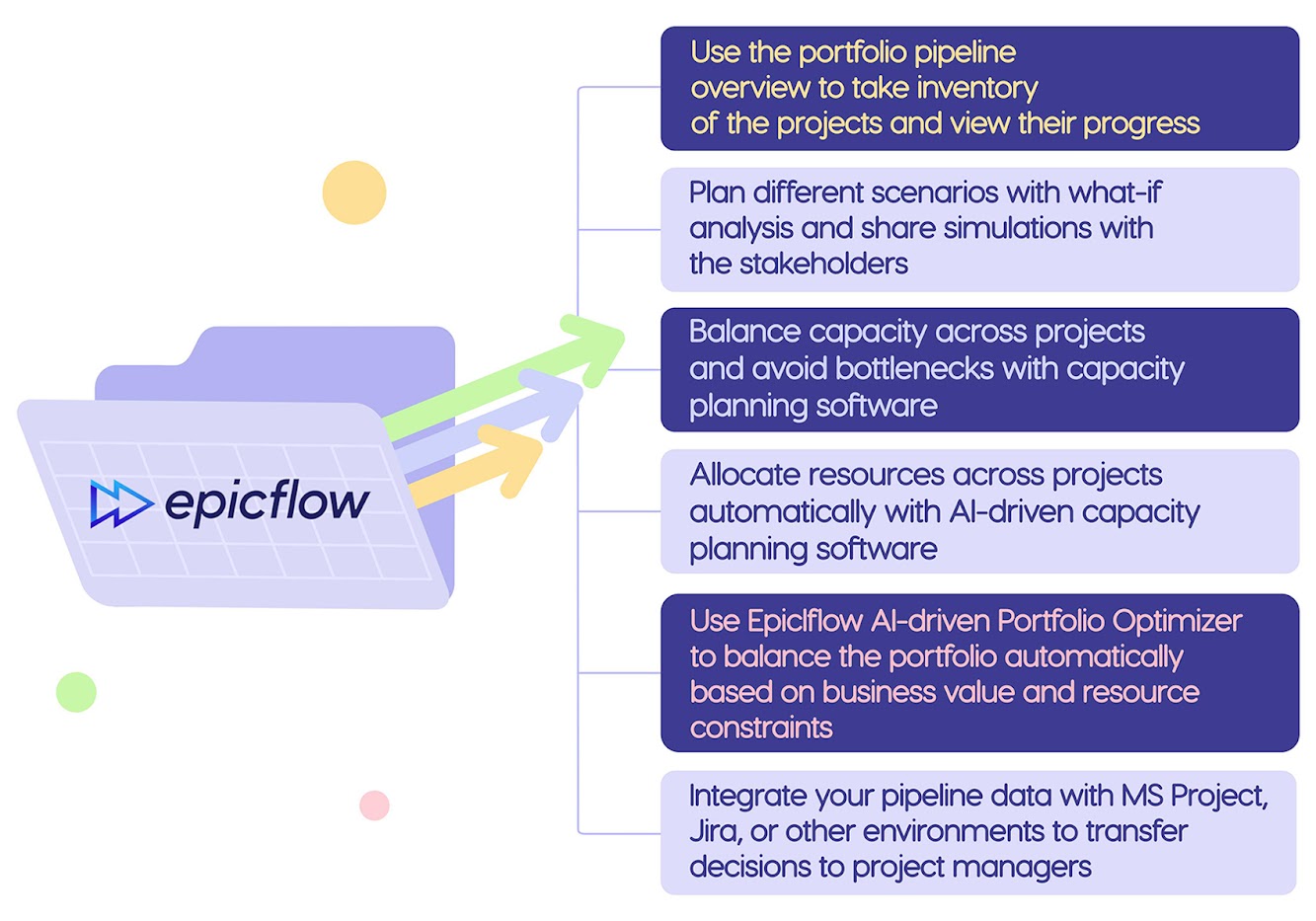

How Epicflow Can Help

Managing a complex R&D portfolio is almost impossible without the right tools. Let’s explore how Epicflow resource management software suite can help your organization.

- Use the portfolio pipeline overview to take inventory of the projects and view their progress.

- Plan different scenarios with what-if analysis and share simulations with the stakeholders.

- Balance capacity across projects and avoid bottlenecks with capacity planning software.

- Allocate resources across projects automatically with AI-driven capacity planning software.

- Use Epiclflow AI-driven Portfolio Optimizer to balance the portfolio automatically based on business value and resource constraints.

- Integrate your pipeline data with MS Project, Jira, or other environments to transfer decisions to project managers.

If you want to know more details about the application of Epicflow’s software suite for R&D, book a call with our team.

Conclusion

Managing an R&D portfolio well depends on several factors. Having a clear understanding of your business priorities, correctly estimating the business value of each project, having the agreement of all stakeholders to implement the changes, and analyzing your portfolio’s performance to understand what you need to change to improve it.

Create prioritization frameworks and use analytical PMO tools to optimize the portfolio, and you can see good results in 6-12 months.