A PMO’s job is seldom easy. As incentives and projects pile up and resources remain limited, delivering everything on time, balancing resource capacity, and delivering tangible business value becomes an almost impossible task.

Sometimes the answer to managing multiple projects in a portfolio is not shifting them around, it’s cutting out the irrelevant ones. Portfolio rationalization is the framework that allows PMOs to analyze and make decisions to kill or postpone low-priority projects to benefit the portfolio as a whole.

In this article, we’ll explore what is portfolio rationalization, what are its main challenges, and how you can create a portfolio rationalization strategy for your organization.

Key takeaways:

- Portfolio rationalization aims at reevaluating projects’ contribution to driving business value.

- The most common challenge is properly assigning value to projects.

- Use decision-making strategies like the AHP or the Eisenhower matrix and run PPM analytics to overcome that.

- The result is a cleaner portfolio focused on delivering value to your organization.

What Is Portfolio Rationalization?

Portfolio rationalization is the process of analyzing and evaluating a portfolio that includes:

- Sorting projects in a given portfolio by business value.

- Prioritizing execution of projects that deliver the highest value.

- Discontinuing low-value projects.

The result of portfolio rationalization is a cleaner portfolio that contains fewer projects, each helping a major business goal. The goal of this process is to:

- Align projects in a portfolio with larger business goals.

- Optimize resource allocation.

- Improve project performance.

- Prevent bottlenecks and delays.

- Maximize portfolio ROI.

The core idea of portfolio rationalization is straightforward: killing or putting on hold low-priority projects allows your organization to focus its limited resources on projects that matter, to have an easier time managing the portfolio, and ultimately to deliver better business results.

The same process can apply to other business areas, like product portfolio rationalization for changing the product lines or tech portfolio rationalization for optimizing IT spend.

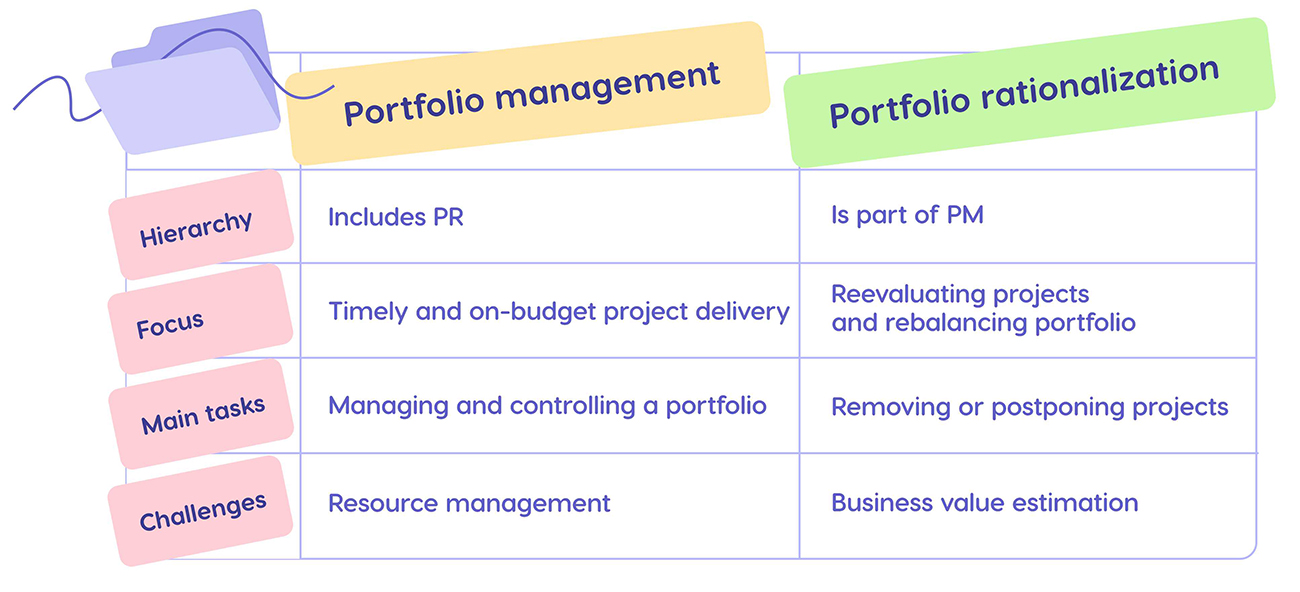

Portfolio management vs portfolio rationalization

Why Portfolio Rationalization Is Crucial for Business Success

In large organizations, personal preferences of CXOs and budget availability often dictates whether a project starts or not. This leads to misalignment, portfolios overloaded with irrelevant projects, and wasted effort. Portfolio rationalization is meant to change that and align the portfolio with larger business goals and your current resource capacity.

Align organizational efforts with goals

In large enterprises, projects tend to pile up. Nice-to-have features that either bog down the portfolio pipeline or are put on hold indefinitely. Product lines or clients that were once important for business growth but have long outgrown their usefulness.

All of these overload the limited resources available to you while providing little value to the business as a whole. Removing these projects from a portfolio ensures that all activity your company engages in produces tangible results.

Optimize limited resources

Killing low-value projects clears up the portfolio and frees up resources that were engaged in those nonproductive projects. This leaves you with more work hours and capacity to spare on the endeavors that matter.

Improve efficiency

A smaller, more aligned portfolio will always be more efficient in delivering business value. As project bloat is reduced, resource overload is lifted, and lead times improve.

Improve decision making

Reducing the number of active projects and following a value-based portfolio management framework also makes the job or a PMO much easier. With less projects to manage, clearly defined strategy, and a clear framework to assign priority, making portfolio management decisions becomes much easier.

This, in turn, adds to the improvements in productivity because it’s easier to avoid resource overload and keep deadlines in check.

8 Steps to Build a Successful Portfolio Rationalization Strategy

Now, let’s look at how you can create a portfolio rationalization model for your organization. The goal here is not to do a one-off audit but a framework for continuous analysis and decision making.

Create a clear picture of business priorities

Since the portfolio rationalization definition implies aligning the portfolio with business priorities, taking inventory of those is the first step. Your organization might have a document that formally summarises those goals. If that’s the case, studying that would be enough.

If not, you’ll need to run a series of interviews with CXOs to understand the strategic picture.

If neither the strategy documentation nor CXO interviews do not produce a cohesive picture, rethinking business priorities might be in order. Without a straight path forward produced at the highest level of the organization, portfolio organization is meaningless.

Take inventory of the portfolio

The next step is to understand what your portfolio contains. Look through it in your portfolio management tool and create a list of all ongoing, planned, and on-hold projects. You can also note project progress for each along with other project management metrics like risk factor.

At this stage, you should also take inventory of the resources available to your organization. Take note of the number of work hours available to spend and of the skillsets found in the workforce. It’s best to use resource capacity planning software to have a customizable view of the whole list.

Assign business value

Now, with the list of business priorities and projects, assign business value to each project. That’s not a simple process and many portfolio management professionals struggle with it. The main reason is, there’s a lot of subjectivity to project prioritization.

Let’s look at a few decision making matrixes that bring objectivity to this process.

The Eisenhower matrix or urgency-importance matrix:

- Align all of your projects across two axes: urgency and importance.

- Urgent and important projects take priority.

- Important but not urgent projects can be planned to be executed later.

- Urgent but not important projects can be delegated.

- The rest can be easily scrapped.

Another variant of this matrix is one centered around the axes of value and effort.

Analytical hierarchy process (AHP) as described by PMI:

- Gather portfolio stakeholders — CXOs, PMOs, and department representatives.

- Create a list of business value criteria.

- Assign weights to each criteria.

- Assign criteria values to each project based on stakeholder voting.

- Calculate the overall business value of each project.

You can use any convenient measurement to calculate business value: Likert scale, percentages, or anything else that you’re comfortable using. Epicflow uses scale from 0 to 1000 to describe business value, which allows you to sort projects accordingly and visualize priorities.

Use analytical tools

Ultimately, if you’re using the AHP method, you’ll have to decide what value will be the cut off point. The projects with lower business value than that should be discontinued, and the ones with higher values will make the cut.

Making this an arbitrary number based on opinions of the stakeholders is faster, but can lead to inefficiencies in managing a renewed portfolio. It’s much better to base the decision on analytical data. This gives you a more informed vision of how different rationalization criteria impact the portfolio.

PPM software like Epicflow can help you perform AI-driven performance analytics to understand overall portfolio performance and prioritize it based on business value delivery. Contact our team to explore how it can help you achieve portfolio rationalization goals.

Make decisions

Based on your evaluation, make decisions on what to do with the projects in your organization’s portfolio. There are the four main options you have.

- Change a project. If a project can provide value with minor changes, go ahead and apply those. This might mean reducing the scope of a new feature to spend less resources on it or changing pricing of a service or a product you provide.

- Approve on hold projects. If a project has been on hold indefinitely because it doesn’t provide immediate value, but you find that it can contribute greatly to long-term success, approve and plan for it.

- Put a project on hold. If a project does have business value, but it’s not as important or urgent as the others, put it on hold or postpone it until enough resources are available.

- Cancel a project. If a project doesn’t fit into your vision of the portfolio, discontinue it.

As a portfolio in need of rationalization can be rather bloated, there’s always a tendency to try and cancel as little projects as possible. Half-measures like that can make your efforts ineffective.

Create a definite cut off line based on business value and stick to it. Otherwise, your resources will still be overloaded with projects that don’t deliver enough value to be justified.

Monitor performance

Once you have made the decision to change or cut projects, implement your plan, and monitor how it impacts the business as a whole.

Project management metrics like lead time and resource workload deserve your attention, but the main focus should be on general business health metrics. Accurately measuring these will help you improve further portfolio rationalization efforts.

Iterate

Based on the performance data, make changes to your portfolio and the rationalization strategy as a whole.

If the PMO metrics aren’t improving and you still see overload and long lead times:

- It can be a prioritization problem, not a rationalization problem. The organization doesn’t want to shift schedules to finish the projects with the highest business value first.

- The cut off line might be too high and the portfolio is still overloaded with irrelevant projects.

If the general business metrics aren’t improving:

- The organization’s goals and priorities may be unrealistic.

- The criteria for assigning business value to projects might be skewed.

- You might be looking at an intermediate effect of investing in projects that bring value in the long-term.

The last point is important to emphasize. If you expect your rationalization efforts to focus on delivering business value long-term and growing the company instead of increasing cash flow at the moment, you might have to expect short-term losses. Set up clear timelines to measure outcomes in the right timeframe.

Repeat portfolio rationalization sessions on a schedule

A successful portfolio rationalization is not a one-off effort. You need to do it regularly, both scrutinizing your rationalization strategy in the light of new data and applying it to the portfolio you have at hand.

Since it’s a long process that requires a lot of data gathering, analytics, and decision-making, it’s best to repeat it no more than once every six to twelve months.

Common Challenges in Portfolio Rationalization

A process as complex and as important as portfolio rationalization is bound to have a lot of challenges to it. Let’s look at some of the most widespread ones, some centered around PMOs’ perception of the issue at hand and some around technical issues.

The sunk cost fallacy

One of the most common challenges that comes with the necessity of discontinuing projects is a purely human error, the sunk cost fallacy. When your organization has poured hundreds of work hours into a project, it’s easy to think that finishing it would be the only reasonable thing to do. In some cases, when, say, the finish line is very close, it might. But in most, the number of hours already burnt is irrelevant.

If that’s what’s stopping you from cutting a project, try not to treat it as a project you’ve invested in but as a completely new project. Assess its business value and the amount of resources it would take to finish it. If it would make sense to start a project like that at this time, let it remain in the portfolio.

If you wouldn’t do it with a new project, the old project is not worth finishing either.

Focusing on the short-term

Portfolio rationalization focuses on delivering business value in an optimal way, and it’s easy to mistake it with focusing on short-term profit. Cutting expensive programs that won’t benefit the company for the next few years to focus instead on the here and now can result in a successful quarter. But it won’t make the company successful in the long run.

If you find yourself prioritizing project with short term value, ask yourself these question:

- Which projects/products/features are indispensable for the company’s success in 10-20 years?

- Which projects can support the company’s growth, either through innovation or through cash flow with good ROI?

- Which projects are just nice-to-haves?

Focus on balancing projects that can bring in cash flow in the short-term, and ones that can determine the future of the company.

Stakeholder resistance

Since a lot of decisions you take during this process depend on stakeholders agreeing on what’s important and what’s not, the human factor can play a major role in reaching a positive outcome in rationalization. Stakeholders that are too attached to certain projects can prevent you from discontinuing them, even if the raw numbers clearly indicate it’s a lost cause.

Overcoming it might not be possible with facts alone. You need to listen to them, understand their point of view, and work on a solution together. This reframes the dynamic from you trying to end their pet project to both of you creating something much better.

Tracking value delivery

A common issue most portfolio managers run into is the inherent difficulty of tracking business value behind projects. It’s not an entirely subjective metric, and there are multiple methodologies for tracking it.

Try out different methods and feel free to add your own factors or change the weight of certain factors in the evaluation. Most importantly, check your business value framework against core business KPIs.

If after focusing on projects with high business value you see that revenue is growing steadily, your evaluation framework is probably correct. If it’s not, you may have to revise it.

Portfolio Rationalization Examples

Let’s look at a concrete example of how portfolio rationalization can improve performance. Dutch Ministry of Defence decided to turn to Epicflow to combat the problems that were plaguing the organization:

- Too much work in progress.

- No clear way to prioritize projects.

- Finance-driven prioritization.

- Resource overload and delays as a result.

Among other things, the Epicflow team helped the MoD to:

- Overcome stakeholder resistance by providing data and performance simulations.

- Take inventory of multiple ongoing projects.

- Find a framework to assign business value to projects.

- Find bottlenecks and inefficiencies.

- Prioritize and stagger projects based on value.

As a result, the Ministry of Defence was able to:

- Cut lead times by over 30%.

- Improve due date performance by up to 300%.

- Deliver the top 50% projects up to 424 days earlier than planned.

Measuring the Success of Portfolio Rationalization

To gauge whether your portfolio rationalization efforts are working, you need to set up an effective tracking system. We recommend measuring portfolio performance and business value delivery at portfolio level as well as real business value impact at project level.

Among the PMO KPIs you can track are:

- Project success rate. What portion of projects are delivered within the given constraints.

- Resource utilization. A measure of how under or over utilized your resources are.

- Return on investment. The ratio between investments in a project and its financial outcomes, which can be harder to calculate for R&D and growth-oriented projects.

- Budget variance. The difference between planned and actual work hours burned.

- Schedule variance. The difference between planned and actual delivery dates.

- Strategic alignment KPIs. The percentage of projects aligned with the business strategy.

- Benefits realization. Planned vs actual benefits delivered to the company.

- Risk response time. The average time it takes to manage risks that occur in the portfolio.

To measure the business value a rationalized portfolio delivers, track a mix of financial, operational, and customer metrics. The exact list will depend on the current organizational goals that the portfolio needs to achieve. Here are a few that you might track:

- Net profit.

- Net profit margin.

- Revenue growth rate.

- Inventory turnover.

- Customer satisfaction.

- Customer retention rate.

Finally, scrutinize projects and their planned and real contributions to business value. For customer-facing projects, like running existing product lines or working with existing clients, this can be easy. You need to simply gauge the investment your organization makes into the project versus the monetary value it receives.

For internal projects like R&D or updating assets and processes, it’s much more difficult because you won’t have the data needed for calculating ROI immediately. Here, you’ll have to either rely on projected value, or wait until the benefits from the project can be realized to bring value. Depending on the industry and the project at hand, it might take years, though.

Remember to review the KPIs you track periodically to ensure they’re in line with what results you want to measure. Consider the timeframe of measurement, especially for projects that do not produce value immediately.

How Epicflow Can Help With Portfolio Rationalization

Epicflow is AI-driven PPM software that helps PMOs in managing the day-to-day of project management operations, coordinating shared resources, and supports organizations in implementing portfolio management strategies. Its innovative AI portfolio optimizer is the right tool to use for performing portfolio rationalization.

This tool will rearrange your portfolio according to business value and give you an understanding of what projects should take priority, and which can be postponed or discontinued.

Epicflow’s capacity planning feature lets you analyze the resource load you might experience in the future and find ways to rearrange project due dates or resources allocated to them to avoid overload.

You can also simulate how changing the portfolio impacts it with What-If analysis.

It allows you to run simulations of how your portfolio would look like if you were to stagger projects or put them on hold. You can experiment with it to find the ideal cut-off point in projects’ business value and share the simulation with the stakeholders.

Book a call with our team if you want to see a demo of this process or want to know more about the details of implementing it.

Conclusion: Is Portfolio Rationalization Right for Your Business?

Portfolio rationalization can help any organization with a large portfolio to make it more manageable and focused on delivering the maximum amount of business value. Despite the inherent challenges with tracking value delivery and personal bias in its distribution, this process can improve your organization’s productivity if managed correctly.

Take your time developing the framework of assigning business value and use analytical tools to project the best to reduce the portfolio. If you’re interested in ways PMO software can help rationalize your overloaded portfolio, book a call with the Epicflow team.

Frequently Asked Questions

What is portfolio rationalization?

Portfolio rationalization is the process of aligning an organization’s portfolio with its business goals by reevaluating priorities and eliminating or postponing the projects that do not contribute to strategic initiatives.

How to rationalize a product portfolio?

In product portfolio management you need to create business value criteria, take inventory of the projects it contains, assign business value to each project, and review which projects are relevant to the organization’s goals.

What is the difference between portfolio rationalization and portfolio management?

Portfolio management is a more general term for allocating resources and operating budgets and due dates to ensure portfolio performance. Portfolio rationalization is a part of it that scrutinizes whether projects should be pursued or not.

What challenges do organizations face during portfolio rationalization?

Most PMOs will have problems with the sunk cost fallacy and stakeholder resistance, as well as an incorrect focus on short-term gains and the technicalities of value delivery tracking.

How do companies handle stakeholder resistance during portfolio rationalization?

Project management professionals can manage stakeholder beliefs and expectations by engaging in an open dialogue, understanding their point of view, and working on a solution as a team.